I Bought A 2-Bedder Unit In Park Colonial in 2018. I Sold It In 2022. Here Are The Numbers.

In 2018, the BTO flat our family has been staying in crossed the 5th year MOP mark. It was time to make our move.

Before that, my wife and I had long discussions about what to do with our BTO flat. Upgrading and moving has been the common topic we discussed about.

We knew that our HDB can be a comfortable home for our family.

But comfort is not always what we should seek at our age.

We wanted to climb up the next ladder in our property journey and kickstart the upgrading journey.

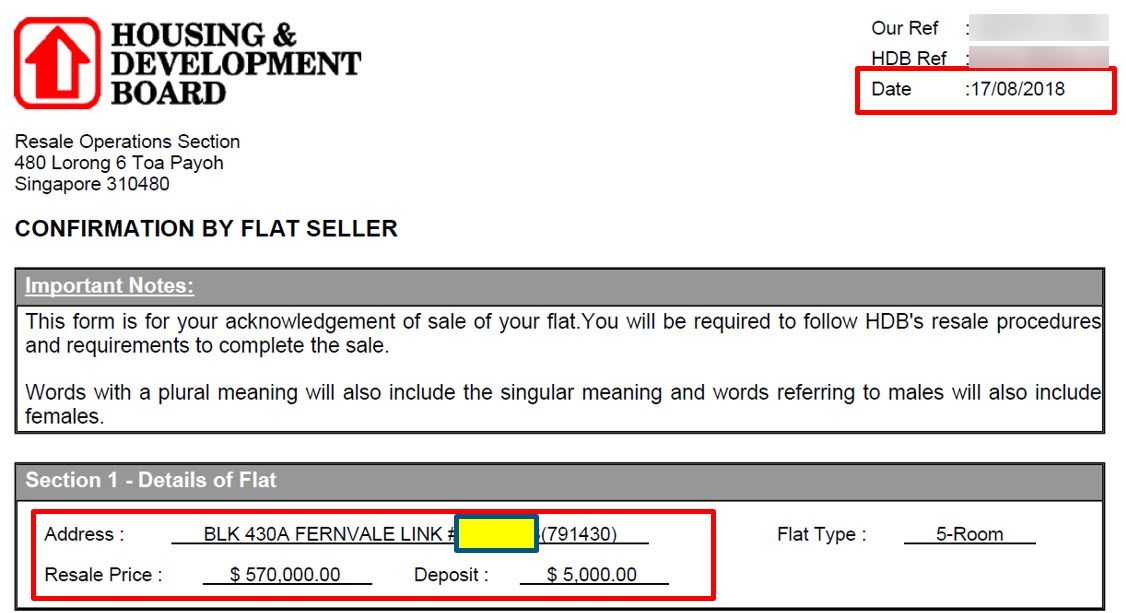

In July 2018, we sold off our 5-room BTO flat upon MOP.

It was sold at $570K.

The following month in August 2018, my wife bought a 3-bedder unit at Park Colonial under her own name.

In November 2018, I bought a 2-bedder unit at Park Colonial under my own name. I bought it at $1.098M.

(Yes, we bought 2 properties that year under our own individual names.)

About 4 years later in September 2022, I sold off the 2-bedder unit at $1.281M.

Here are the final numbers.

The gross profit after 4 years is about $151K.

This means if I based the returns based on the 25% downpayment of $305K, the gross profits is about 49%.

On a per year basis, this means a gross return of about 12% per year for that 4-year period.

However, I have not included our rental costs of $120K for the 4 year period.

The gross gains would be about $151K - $120K = $31K.

What Had Been the Decisions I Made?

Was buying the 2-bedder unit in Park Colonial in 2018 and selling it off in 2022 has been a good decision?

Because it seems I only made $31K in gross gains after 4 years.

Was it worth it?

Did I make an error in judgment?

What were the decisions I made in order to reach this point?

Let's explore.

Decision #1: To Sell Our HDB Flat or Not?

I briefly touched on this earlier in the article. My wife and I actually had multiple rounds of discussions on this topic.

She is an engineer who has been trained to look at numbers.

Similarly, in my previous career, I was a data analyst who crunched numbers on a daily basis.

So for us, the numbers were clear and made financial sense.

Selling our BTO HDB on the 5th year mark would be the best time to cash out and provide some support towards our initial downpayment for our respective units at Park Colonial.

What would stop us from selling?

An emotional attachment to the large space of our 5-room HDB flat.

But we also told ourselves if we didn't do this now - then we would never find another chance to do it.

We were at the point where our salaries have peaked and yet young enough to be able to get a comfortable loan amount.

This was a sweet spot in our lives.

So we made the decision to sell our HDB flat in order to upgrade.

Decision #2: What Should Be Our Next Home?

At the beginning, we wanted to buy a resale condo unit.

The main reason?

We wanted to avoid the hassles of renting. We thought we could sell our HDB flat and immediately move to a resale private condo.

But during our search, my wife could not find a resale unit she liked.

For her, location is important due to the commute to her workplace. It is not as important for me.

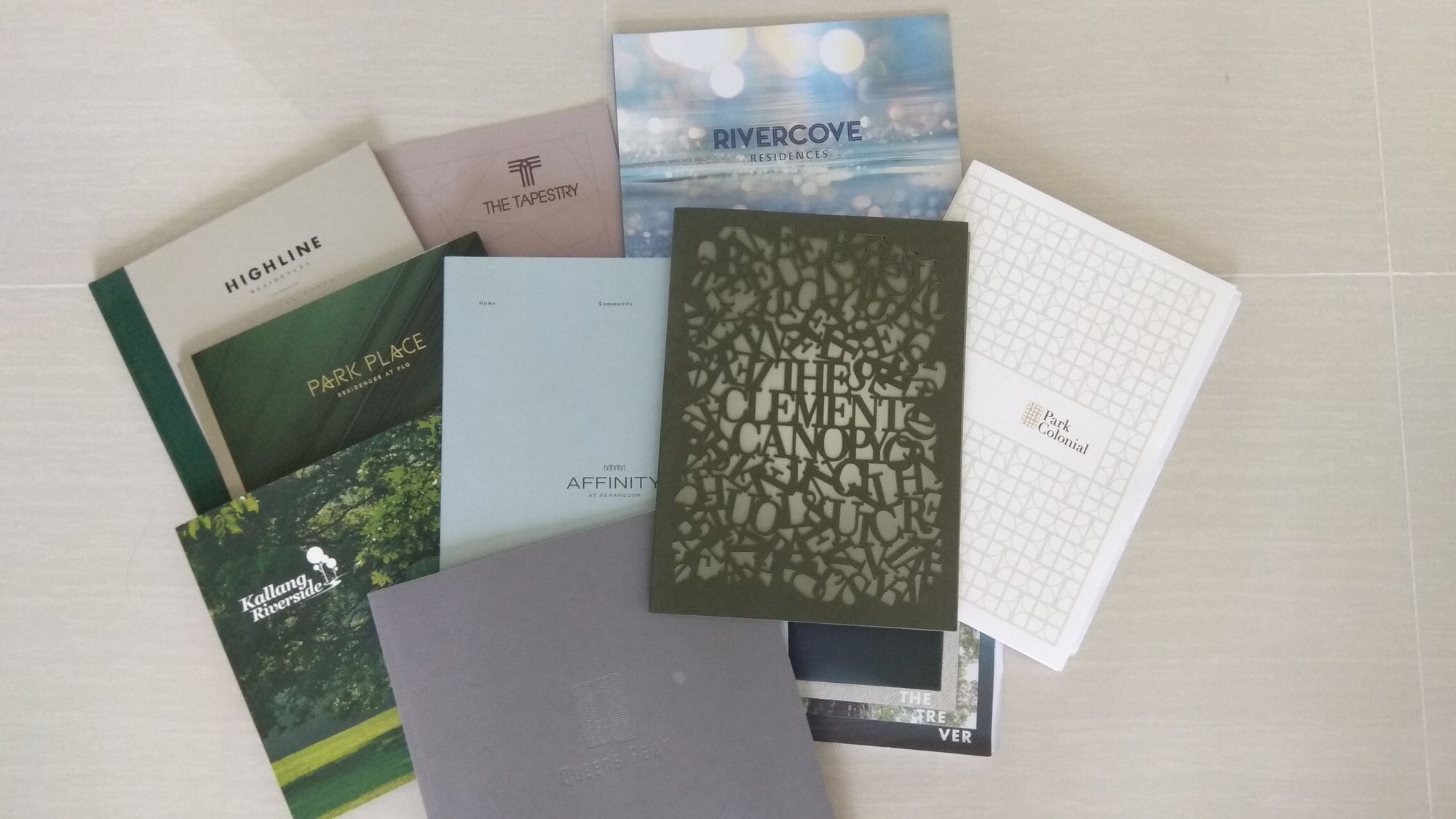

We went to look at new launches as well - 2018 was a year where there was a bumper crop of launches from various developers.

So there was a benefit of very competitive pricing as the developers tried to attract buyers to boost their sales.

In terms of prices, the choices we looked at was quite similar.

But my wife somehow fell in love with Park Colonial. The idea of moving to a brand new unit with these various amenities was appealing.

So we gave up the idea of buying a resale condo unit.

For me, it was more important that my wife liked it.

Happy wife, happy life.

Decision #3: What Is Important To Us?

The next decision we had to make was recognizing and weighing what was important to us.

And this was the thought that kept coming back to us.

The notion that we cannot be too complacent when opportunities are presented to us.

I knew we cannot too dependent on anyone else to take care of us for our future.

We cannot become too reliant on:

- a job

- the government

- relationships with friends & families

And if we do have supportive friends and families with good relationships, then we consider that as an additional blessing. Remember, other people also have their own lives to live.

So we have to depend on ourselves first by making decisions that are not driven by fear.

Instead, make decisions that are driven by our values and principles of being financially independent.

And that is why we chose to capitalize on the opportunity:

- being able to leverage on a low cost property loan

- cashing out of the gains of the BTO

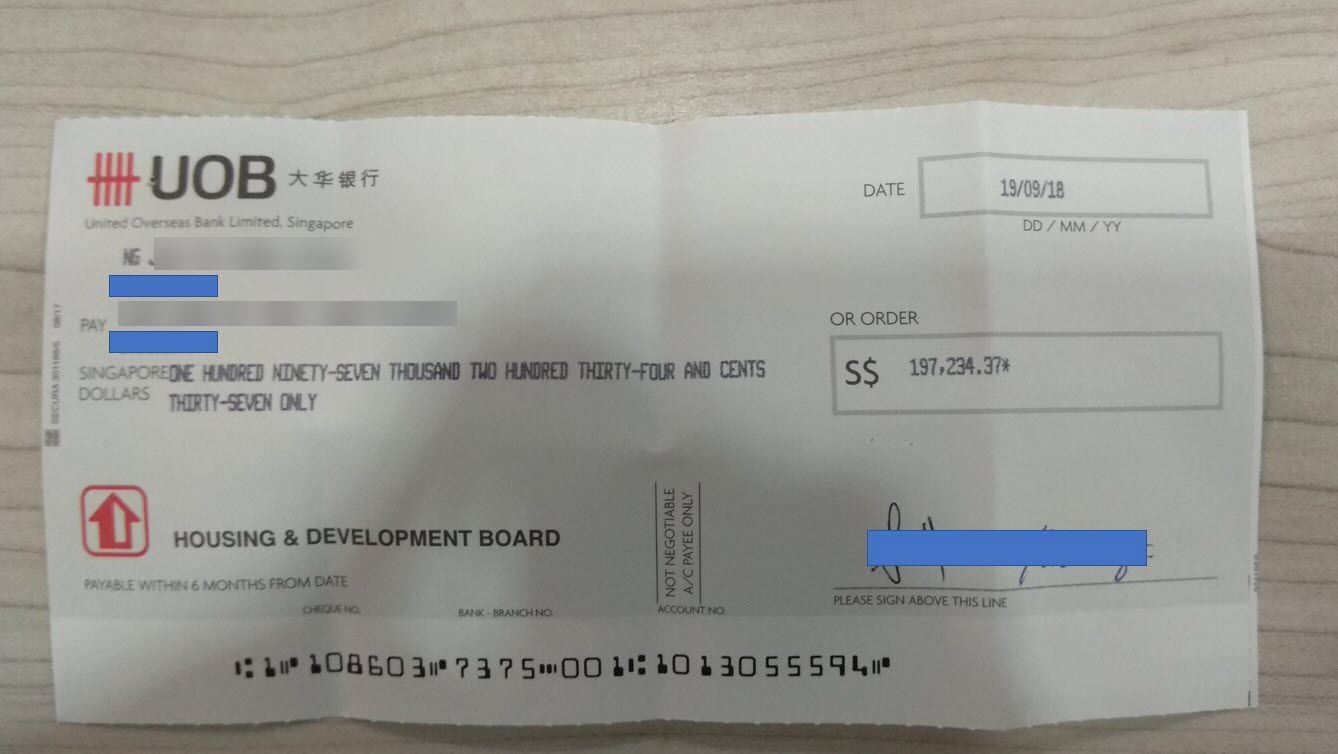

After we sold off the HDB flat and received this cheque, our family essentially became homeless.

Decision #4: Are We Willing To Be Uncomfortable For Our Future?

After selling our HDB flat, the reality we had to accept was essentially becoming "homeless" and accept that we are going to become tenants in someone else's property.

Not for 1 year.

But for at least 4 years.

This is a very uncomfortable truth for some people to accept especially if been staying in their own homes all their lives and never paid a single dollar in rent.

But we chose to accept it.

In fact, I made the decision to rent a smaller 4-room HDB flat so my family of 4 can get used to a smaller space.

Our rental costs throughout the 4 years added up to $120K.

If I were to shoulder the rental costs alone, it is a lot.

It seems that I only made $31K in gross gains.

But do take note, my wife also bought a 3-bedder unit as well.

Now, assuming I shoulder only $60K while my wife bear the other $60K...

This means I made essentially $31K + $60K = $91K in capital gains.

By being uncomfortable for 4 years, there was this additional $91K in my pocket.

But my wife also gained a brand new property that satisfied our aspirations of private property.

More importantly, this entire journey boosted our confidence greatly that being uncomfortable for awhile to achieve our dream is possible.

Decision #5: When To Sell Off To Cash Out?

I bought this 2-bedder Park Colonial unit in November 2018. Sold it almost 4 years later in September 2022.

Could I have rented it out for cash? Yes.

However, I chose to sell it off early because the newly TOP unit is essentially at its highest value.

No one has ever lived in it so that commands an additional premium.

The fact the development looks so fantastic because it is so new brings up feelings of emotional desire within potential buyers.

It is an emotional pull that I wanted to take advantage of.

Hence that's why I sold it rather quickly at $1.281M.

Did I lose it out on some gains? Perhaps.

Some similar-sized units are selling at $1.3M.

Conclusion

Today, I am still weighing the costs and benefits of the decisions we made 4 years ago.

If I want to comfort myself and make the numbers look good, I simply have to adjust the rental costs. Haha.

So assuming that my share of the rental costs is $60K, my capital gains would be:

$151K - $60K = $91K

Considering the downpayment of $305K, the returns from this property purchase will be about 30% over 4 years.

This means an annual return of about 7.46%.

Was it worth it?

Let's see.

In August 2022, the estimated inflation rate just for food was estimated to be 8.2%.

The overall inflation rate is expected to hit 7%.

Singapore’s core inflation hit its highest level in more than 13 years in May. A breakdown of rising prices: https://cna.asia/3xKprM1

Posted by CNA on Thursday, June 23, 2022

So what does it mean?

It means, if I didn't make this property purchase, I would have definitely lost more purchasing power.

While it may seem that I did not make significant monies, by parking some of my investments in a physical property - it has shielded my money from the worst impact of inflation.

One good thing about inflation is it also pulls up the prices and value of our properties.

So by making the decision to pull out some of my paper assets to park inside this Park Colonial unit, I have limited the loss of my purchasing power.

At the very least, I am quite sure I broke even.

Was it perfect? Of course not.

Could I have made more gains?

Yes, if I had bought another new launch development.

If I had bought a unit in that other development, my gains would probably be at least 50% more.

But for the sake of family happiness, we bought this development instead.

In life, every decision we make is a trade-off.

In order to gain something, we have to let go of something else in the process.

In order to seek financial independence, we had to let go of comfort.

What do you think?

Would you and your spouse have made similar decisions like what we did?

Let me know.

And if you have questions on your own property journey, feel free to drop me a message via whatsapp.

Member discussion