Should You Fully Pay Off Your HDB Loan With CPF Monies?

This is a very common question being asked online. Reading various online forums and threads, you will find a lot of answers.

Personally, I asked various people around me about this topic from financial advisors to chartered accountants, employees and employers.

There is no really straightforward answer to this question.

The perspectives and reasoning will vary a lot.

Because it is really depends on your own life situation.

Here is my take on this question as someone who went through the journey of:

- buying and selling our BTO

- buying 2 private properties and selling 1 off for profit

- being a parent with 2 children + a husband to a working spouse

- a son with elderly parents

- being a former employee with a regular pay cheque who turned into a realtor with no fixed income

My viewpoint and perspective might be similar to yours. Or it can be very different.

Let's explore.

The Attraction of Having Zero Debts

Growing up, we were probably inculcated with the mindset that debts are bad.

For me, I grew up being taught the importance of savings and avoiding debt as much as possible.

And so when the time came to purchase our property, we probably made an unconscious decision that it is best to pay off our HDB loan as quickly as possible.

We pay off our credit card debt in full every month.

So why not make the effort to pay off our HDB loan as well?

This was probably our initial thoughts and trajectory.

Like most people, I believe being free of debt is a good idea and something to aspire for.

However, there are some drawbacks to fully paying off your HDB loan with your CPF monies.

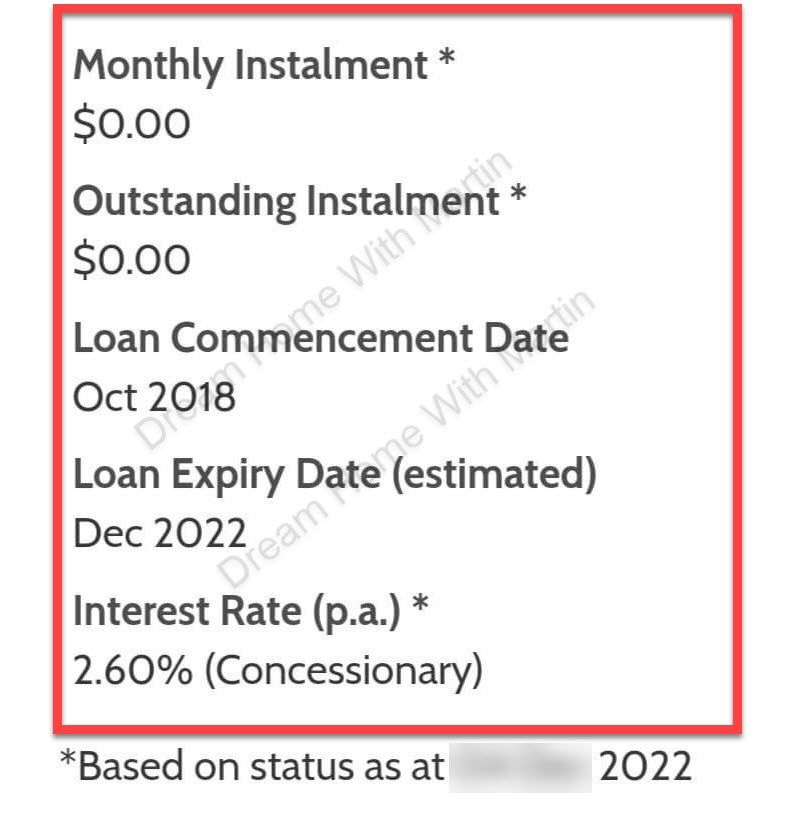

#1: Your CPF Accrued Interest Will Start to Snowball

Every month, we pay down our monthly mortgage via monies from our CPF OA.

We are essentially "borrowing" small amounts of monies from our CPF OA to pay for our HDB loan.

At the same time, CPF keeps track by showing you the accrued interest that has built up - the amount of interest you could have earned had you chose to keep your monies in the OA.

Now, you look at your monies in your CPF OA.

You see that it has more than enough to completely pay off your HDB loan.

So you transfer over a significant amount of about 5-figures or 6-figures - pulling it out of your CPF OA - and paying off the HDB loan.

At this point, you think you stopped the clock on your HDB loan.

No more 2.6% interest! Yay!

However, you actually started another clock.

Previously, you "borrowed" only small amounts from CPF OA.

So the CPF accrued interest was relatively small as well.

Now, you "borrowed" an even bigger amount from CPF OA, hereby kickstarting another clock.

The clock of CPF accrued interest.

You will notice that your CPF accrued interest will start to jump and snowball.

Because that amount... is the amount you could have earned had you chose to keep those monies in your CPF OA.

So is this a problem?

#2: CPF Accrued Interest Becomes An Issue When You Want To Sell Your HDB Flat

There are consequences of paying off your HDB loan with CPF monies.

While your HDB loan might be cleared off, you essentially still "borrowed" from your CPF OA.

If you have no plans to sell off your HDB flat, then CPF accrued interest is not a big issue.

But if you plans to sell and upgrade to a bigger flat or condo, you will have to take into account of your CPF accrued interest.

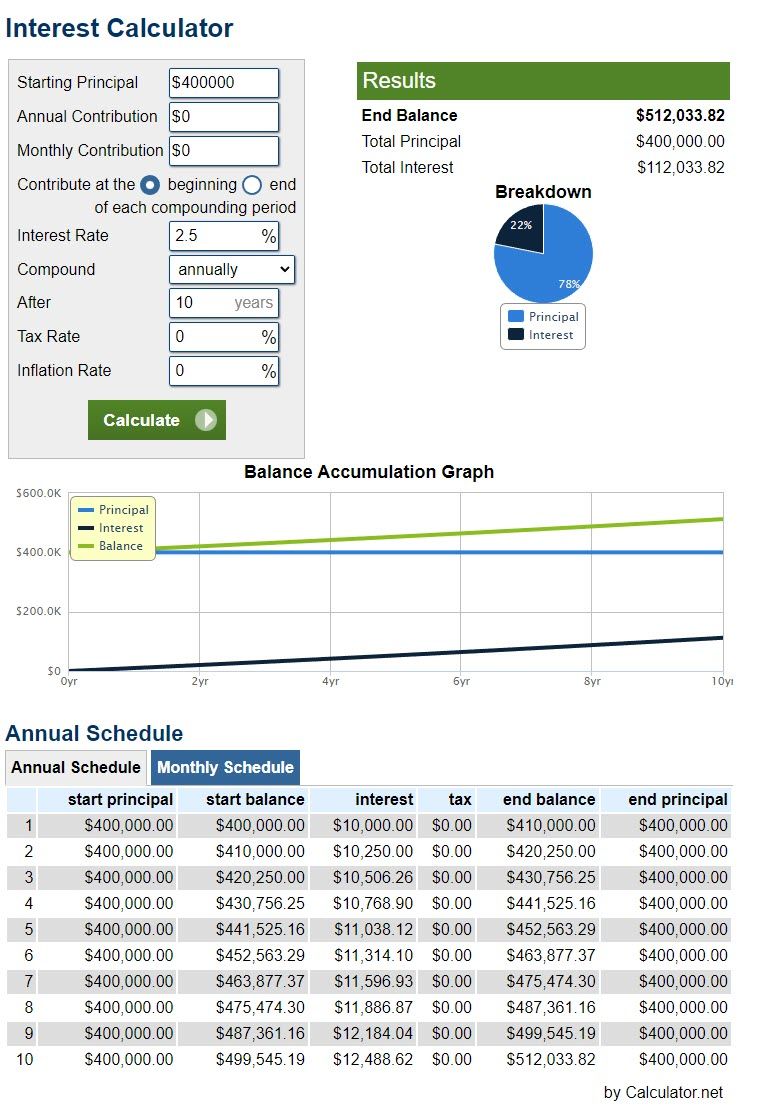

Assuming you used $400K of your CPF monies to pay off your HDB flat in the first year. You have zero loans.

This also means the accrued interest will snowballed to $112K by the 10th year.

This means you have to sell your HDB flat at $512K in order to break even.

Do bear in mind, this is just an example.

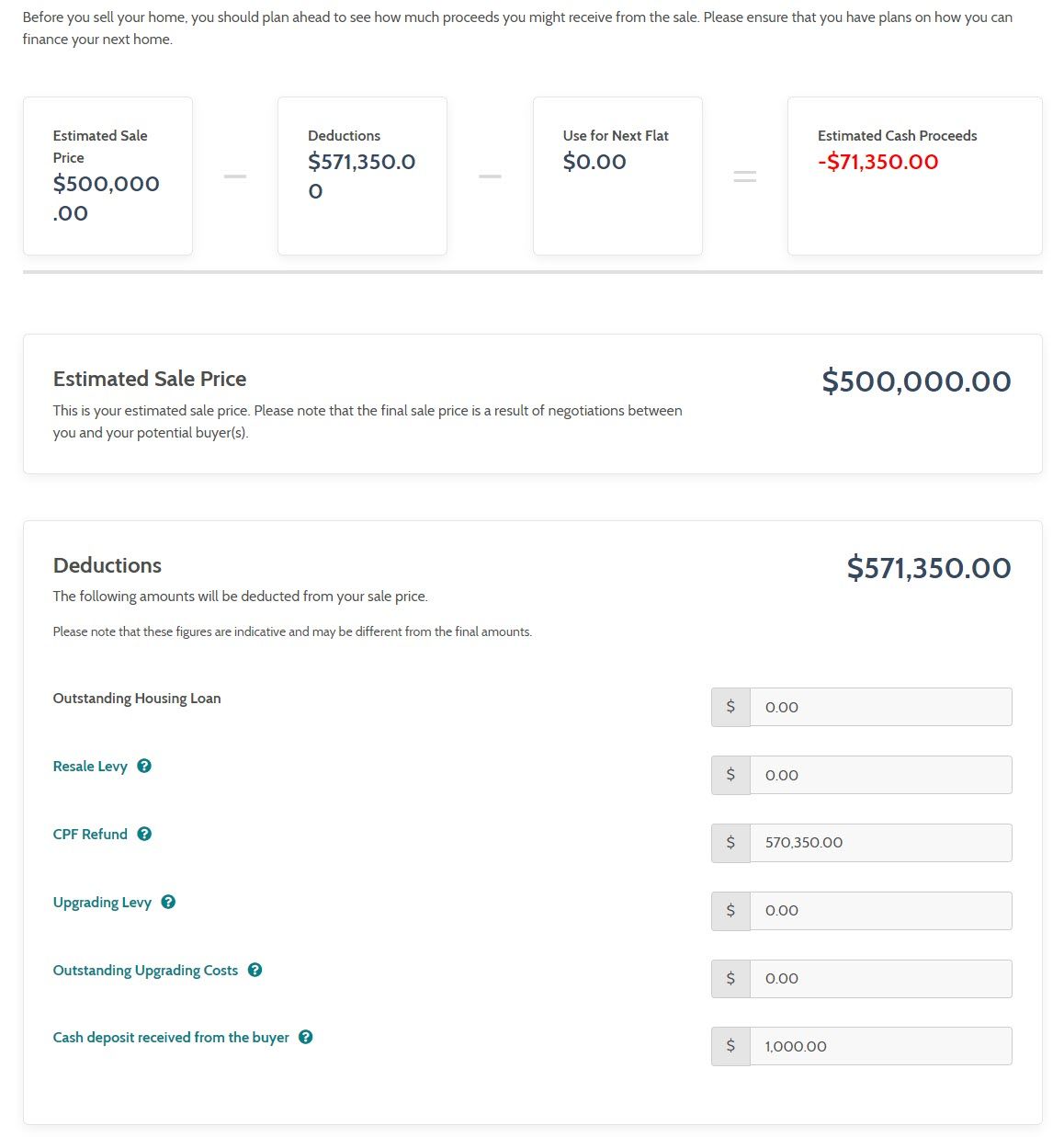

You can check out and estimate your own cash proceeds using the HDB calculator below: https://homes.hdb.gov.sg/home/calculator/sale-proceeds

You can enter an:

- estimated selling price of your HDB flat

- your outstanding HDB loan

- the amount of CPF monies used

- the CPF accrued interest built up

If you see a red number, this is basically a negative cash sale.

It means there are no sales proceeds.

This was very common during the years before the pandemic - when HDB resale prices were depreciating and selling at high prices means there would be no takers.

3,100 flats in Jurong West, Kallang Whampoa and Sengkang will be offered in 2019's first BTO sales exercise.

Posted by CNA on Tuesday, January 1, 2019

#3: Consider the Illiquidity of Your CPF Monies

So the next question that comes about will be this: Does it mean that I should pay for my monthly installments via cash?

And leave my CPF monies alone so it can accrue the 2.5% interest that is courtesy of the CPF Board?

Now the answer to this question is very different depending on who you ask.

For self-employed people, they are comfortable with paying down their mortgage via cash because they have no CPF contributions.

For employees with regular CPF contributions, do you want to use your CPF monies or cash to pay down your housing loan?

My personal opinion is this - if you have regular CPF contributions, consider this fact:

Your CPF monies is very illiquid and for good reason - it is meant for retirement.

But permission has been given - that you are allowed to use your CPF monies for housing.

So my opinion would be to use your CPF monies to pay down your HDB loan and use your cash to park in investment vehicles that can provide returns better than 2.5%.

Like fixed deposits or T-bills.

Or just consider keeping the cash on-hand for emergency purposes.

If something were to happen, cash is helpful and easily accessible.

But your CPF monies remain inaccessible.

#4: Your HDB Loan Is A Form of Leverage

Property loans in general are a form of leverage. You borrow other people's money at a fixed interest rate to buy a property.

And to make money, you hope that the property's price is able to grow at a rate that is higher than your loan's interest rate.

In the not-so-distant past, people were able to borrow at 1.5% to 1.9% interest rate to buy private properties which appreciated by 3% or more.

Flash estimates for 4Q2019 shows a 0.3% q-o-q increase in private housing price index. Property consultants are projecting an overall increase of 2.5% for the full year in 2019 and 3% increase for this year.

Posted by EdgeProp Singapore on Thursday, January 2, 2020

Property loans from the banks were cheap back then.

That's what I did.

That's what a lot of property owners in Singapore did in the period before 2020.

Today, the HDB loan of 2.6% seems like a solid bargain while the bank loans are now rising to beyond 3.5% and even hitting 4%.

And if your HDB prices were to rise higher than 2.6%, you can be assured that at least you can at least breakeven.

If you have the cash on hand, park it in fixed deposits or other safe investments.

At this stage, where interest rates are high, it is best to stretch out your HDB loan and not be in a hurry to pay it off.

Conclusion

As someone who closely monitors the real estate market, I realized how fast the environment can change.

From HDB resale prices falling every quarter back in 2018-2019 period to the current situation where HDB resale prices are increasing almost every quarter.

“I am losing a lot of money. It’s more than one year. It’s very, very hard to sell,” said home owner Mr Tun Tun.

Posted by TODAY on Sunday, May 12, 2019

The environment changes very quickly.

A bank loan's interest rate might change after 5 years.

HDB resale prices could increase by up to 11% next year, analysts say.

Posted by CNA on Thursday, December 29, 2022

But your HDB loan should remain the same at 2.6%.

Paying off loans to achieve a stress-free life is a worthy pursuit.

However, I believe what is more important is to monitor:

- the amount of CPF accrued interest you have built up over the years

- the recent transaction prices of flats in your area

This 2 figures are the key factors in ensuring whether your property is appreciating in value or depreciating.

Right now, we are in the period where HDB resale flats are being transacted at high prices.

But once supply of HDB flats starts to increase and more flats completing the 5-year MOP mark starts to enter the resale market, this situation might no longer be applicable.

If you are not sure on what are your property options available to you, feel free to reach out for a no-obligation discussion.

We can explore the choices that are open to you.

Member discussion