"Where Did I Go Wrong?" Responsible Father Wonders Where Did His CPF Monies Went - 5 Lessons We Can Takeaway From This

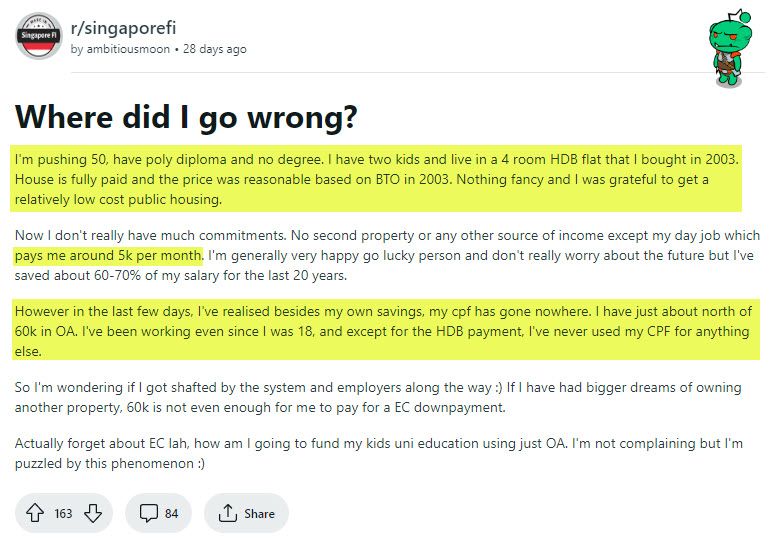

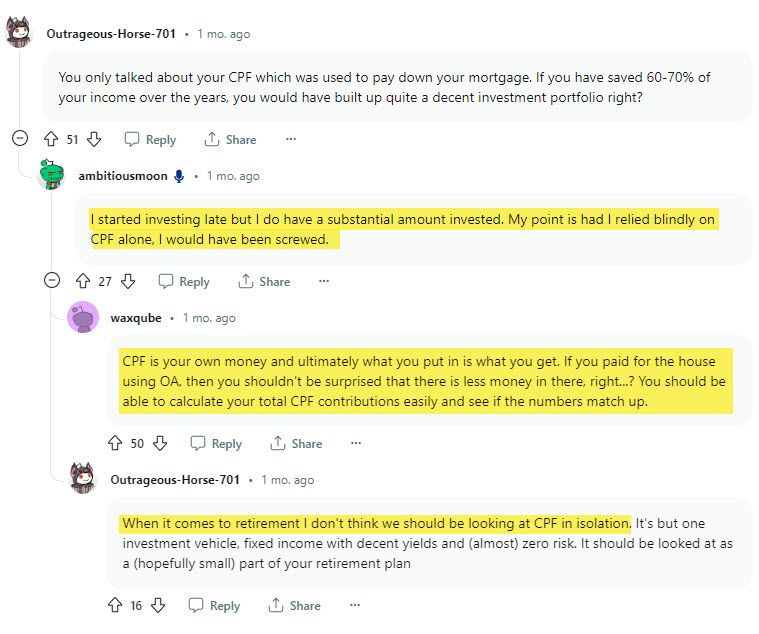

I found this interesting post on Reddit where a father finds himself wondering where did his CPF monies go.

Here is his financial situation:

- almost 50 years old

- bought a 4-room HDB flat in 2003 (means he has been staying there for 20 years)

- HDB was fully paid off in 2017 (took about 14 years to pay off the loan)

- Income is $5K per month

- Used CPF monies mainly for housing

- His CPF OA has about $60K inside presently

His predicament is actually not that unexpected.

This is generally what happens when you pull money out from your CPF to park inside your HDB flat.

As an agent, I see this commonly in homeowners who are 50 years old and above.

There is only so much CPF monies in their OA left as most have been transferred over to their property.

Here are 5 lessons we can takeaway from this situation which I believe is very common but is rarely discussed.

#1: Your CPF Monies Is Essentially Parked In Your Property

This Reddit post should serve as a good reminder that when life happens to us - we will forget the monthly payments we make to HDB is a transfer of CPF monies to our property.

We transfer from one container and to another container.

And this transfer is considered a loan - we are essentially borrowing from our retirement monies.

If the CPF monies were to remain in the CPF Ordinary Account (OA), then we get 2.5% interest on it - courtesy of the CPF Board.

But since we are using the CPF monies for our property mortgage, we now have:

- lost the chance to earn 2.5% interest from the CPF Board

- to also pay the 2.6% interest on the HDB loan

So there should not be any wonder that our CPF monies are used up by the time we pay off our property.

However, are these the only challenges we have to endure as HDB owners?

#2: The "Responsibility" to Earn or Breakeven From The Costs of Financing Our Property

We are essentially borrowing from our CPF OA at a rate of 2.5%.

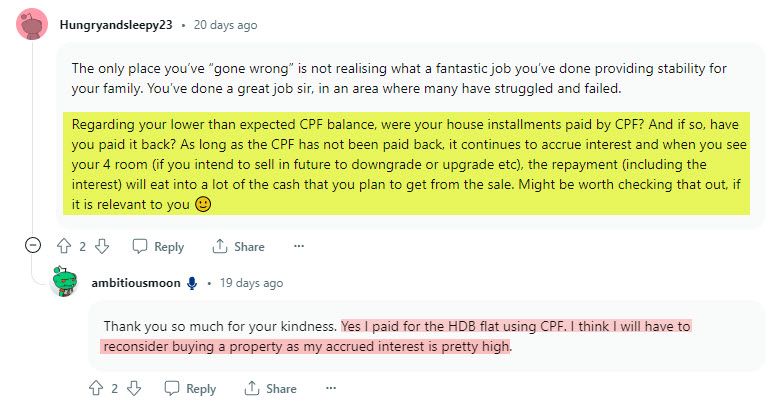

CPF actually reminds you about this when you login and check on the amount of accrued interest that has been built up.

It is a reminder that this is the amount you "owe" to your own retirement accounts.

It is the cost of borrowing.

Is there a way to recover back the costs?

Recover back the accrued interest built up?

Yes, it is possible.

You need to have a property which can increase in value by 2.5% or more yearly.

If your property appreciates by 2.5% yearly, you essentially breakeven.

And if it appreciates by more than 2.5%?

You are in the green.

But if your property drops in value yearly through depreciation, you are essentially losing money.

And that brings me to my next point.

#3: Your Property Choice Is Essential

Your property needs to be able to "perform" in the future.

For some properties, it is able to increase in value quickly.

For some properties, it is able to hold its value.

For some properties, it will enter a depreciation phase.

That's why my spouse and I made the decision to let go of our 5-room HDB flat to upgrade to a private property.

We want to make sure we can capture the gains made and push those gains to a better-performing property.

You can read the reasons here: https://www.dreamhomewithmartin.com/best-advice-as-father-and-property-investor/

#4: Are You Holding On To A Property That Is Performing?

This is a question that you should regularly check the answer for.

Take some time to check out the transaction data of nearby properties similar to you and find out if your property is doing well or not.

Some might say this is not necessary since "my property is my home and making money is not important."

But in an age where a significant sum of our retirement monies is already parked inside our homes, I think it is unwise to not do some form of financial audit of your property.

Otherwise, you might reach the age of 50 years old and wonder where did your CPF monies went to.

The responsibility of "earning" can be placed on a property that can perform well and is positioned to take advantage of a uniquely Singapore property market.

#5: The Decisions We Make Today Will Determine Our Future

Perhaps, instead of having the property responsible for the performance of the property returns, it is more accurate to say that we ourselves are responsible.

Where we stay now is a conscious choice we made.

And if we really think about it, where we are today is due to some decisions we made 5 - 10 years ago.

So where will be in about 10 years' time?

It will be due to the decisions we make today.

But any decisions made should be guided by accurate information we have on hand now.

Being Smart About Your CPF Monies and Your Property

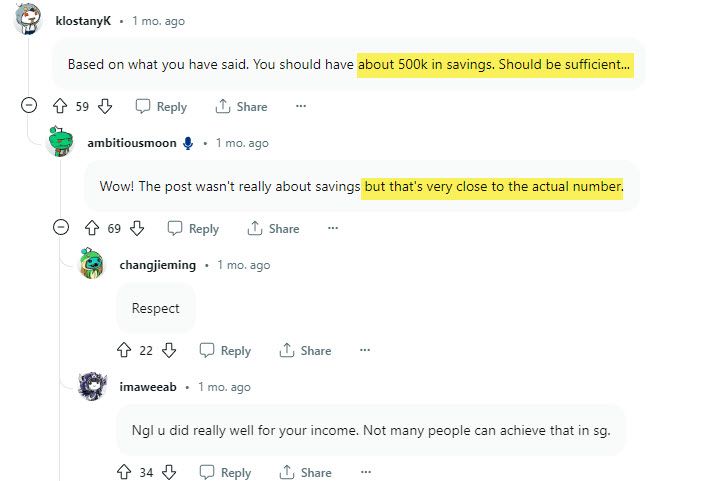

For this responsible father, he did make some smart choices on his personal finances.

So while his CPF account might seem depleted, he does have about $500K set aside in savings and investments.

That being said, what if your plans was to rely on your CPF monies for your retirement?

That would have been dangerous.

The fact is that what we have in our CPF accounts comes from 3 contributors:

- Employee contribution

- Employer contribution

- CPF Board 2.5% interest

And the fact is we will have to pay down our property by our own CPF monies - pulling out from one bank account to put in another bank account.

If you are an employee, I won't expect you to pay for your monthly mortgage via cash.

Why should you since CPF monies is allowed to be used?

But because of this "permission given", you have to be careful on how you use it and think about your own future.

Regular Financial Checks Are Necessary

That's why regularly reviewing your property portfolio and CPF monies is so important.

Just like a health checkup, this is an exercise you should do once per year to check on your financial health.

Using your CPF monies to pay for your property is essentially an opportunity cost.

Give up the guaranteed 2.5% returns from CPF Board and use up your retirement monies instead - just to finance your property.

The trade-off you are doing? You must make sure it is worth it.

In this case, he owns a 20-year old HDB 4-room flat that is fully paid off.

While HDB resale price index is high today, there is no guarantee that he will have a very profitable HDB transaction.

It is very likely most of the gains will be have to be refunded back to his CPF OA - so there is not much cash on-hand.

But let me present to you another option he could have considered.

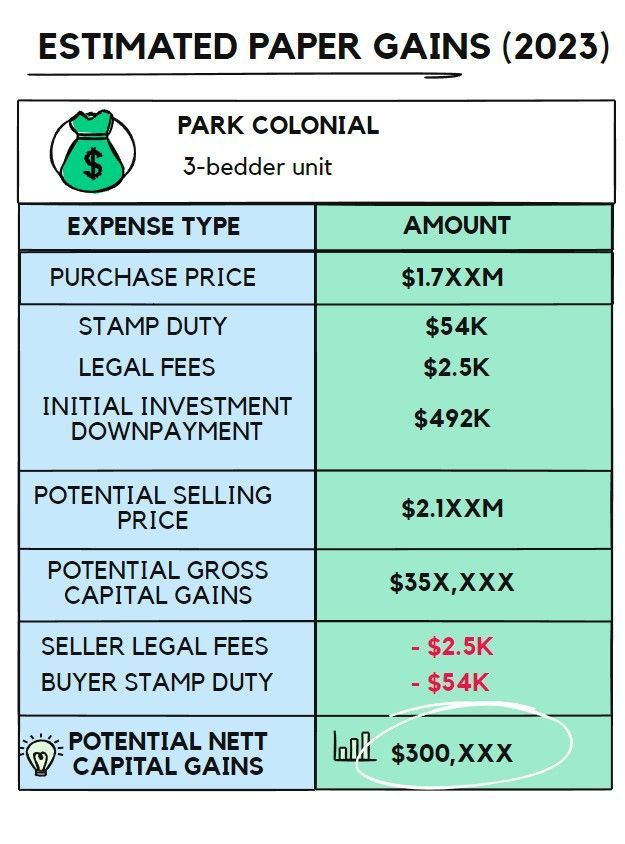

What If He Upgraded to Private Property In 2018?

In 2017, he paid off his HDB flat.

In 2018, the property supply was plenty with many new launches available.

Developers were eager to to offload their new launch units at lower profit margins.

Had he bought a new launch in 2018 in the OCR (Outside Central Region) areas, he would have easily profited about $200K - $300K today in 2023.

My wife and I bought a unit each at Park Colonial in 2018. And the paper gains just for my wife's unit was $300K.

That was an opportunity he had missed out on because likely - he didn't take the time to explore.

Conclusion

There is no right or wrong answer here.

To be fair, I have no idea of what financial circumstances he was in or what type of career he has.

So I am just making educated guesses here.

But what is clear, he felt surprised enough to see his CPF accounts almost empty that he wrote about it on an online forum.

And I think that provided some useful context to all of us younger than him about how we should not be relying too much on our CPF for our retirement.

If you have questions on your own property choices and retirement options, I invite you to contact me for a no-obligation consultation session.

I can share with you how I do the financial calculations and explore what are your options in terms of Singapore property.

Drop me a WhatsApp message here: https://wa.me/6597733445/

Member discussion