Property Developers' Confidence Level: 5 Reasons Why You Should Take Advantage of It

For most people, they tend to view property developers as these huge faceless companies with a lot of power to decide on the eventual selling price of their units.

Although it is true they have the power to set the prices they sell at, what is also true is this - you also have the power to walk away and not buy anything from them.

These developers might be "faceless" but they are also run by humans.

What does this mean?

It means you as a potential consumer of their products - you are not completely powerless.

Let's explore what this means.

#1: Property Developers Do Monitor Their Competitors' Results

In the private property new launch market, we might be led to believe that all the properties are different and hence can stand behind their own unique selling proposition.

People like to say "Oh, they are different. It's like comparing apples and oranges."

While is true to a certain extent, you do have to consider the impact of market sentiment.

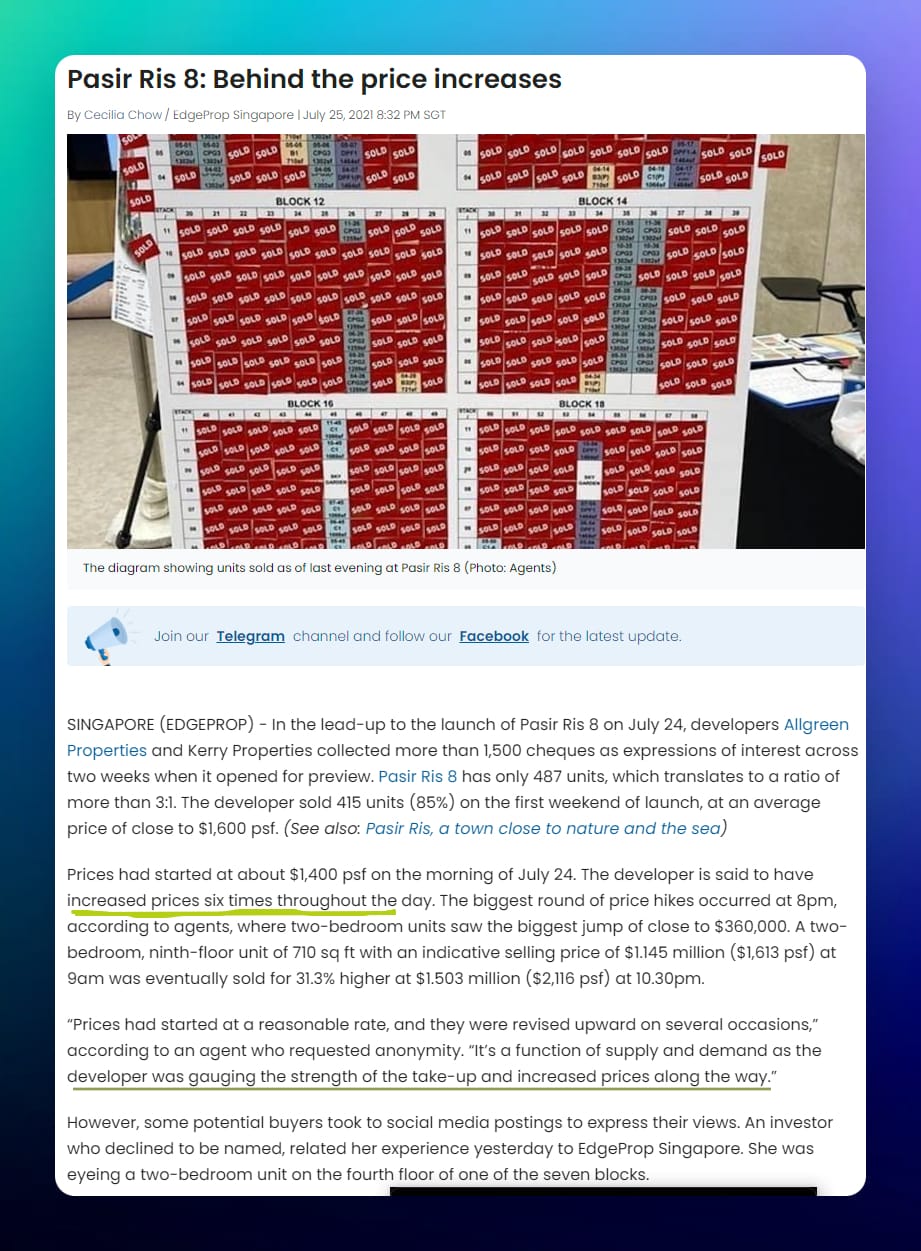

For example, the developers of Pasir Ris 8 took this concept to its fullest potential - when they increased their prices 6 times in just 1 day.

They could sense buyers were keen to snap up the units - so they made their profits through the buyers who bought later.

But instead of increasing prices over a period of weeks or months - they chose to do it within 1 day. This was back in 2021.

However, 3 years on - the market sentiment is now much less buoyant.

For example, I imagine the developers of Lentor Mansion were probably closely monitoring the sales results of Lentoria.

Lentoria was launched in the first week March 2024 where about 50 units were sold at $2120 psf. This was less than 20% of the units sold.

The developers of Lentor Mansion probably saw these results and realized the importance of pricing their units "sensitively".

Two weeks later - still in March 2024 - Lentor Mansion was launched for sale to the public. This time around - 400 units of Lentor mansion was snapped up at prices between $2104 psf to $2478 psf.

To be fair, Lentor Mansion is a development that is geared towards families as they don't even have 1-bedder units available.

That might explain the greater demand for Lentor Mansion when compared to Lentoria.

Lentor Mansion currently holds the record for best-selling development in 2024.

Chuan Park is a 916-unit new launch that is coming up soon for sale in July 2024. (No launches in June 2024 due to school holidays)

If I am a betting man, I would think that the developers of Chuan Park are thinking how to price their units "sensitively" as well in order to achieve similar results like Lentor Mansion.

#2: Property Developers Are Subjected To Rising Costs and Interest Rates

In the past 2 years, the impact of rising inflation has not just hit us ordinary people but also big companies as well.

Property developers are not immune to this as well.

Imagine these are the rising costs they have to face:

- construction costs

- land costs

- interest costs from banks

- marketing cost

If you think you are stressed by rising costs, imagine if you are in the developers' shoes!

Their profit margins are becoming smaller and smaller.

And this is also why you should not expect property prices to drop too much anytime soon.

But they also face the fact that they can't increase prices too much.

So these property developers might feeling stuck between a rock and a hard place.

#3: Property Developers Are Subjected To Recent URA Changes

Back in 2017, there was a huge uproar over the large aircon ledges at a condo development in Sengkang.

There was a loophole back then where developers was allowed to sell these aircon ledges.

It was included in the gross floor area calculations and basically developers could make money from these areas.

In 2022, there was news that URA would change the definition of saleable floor areas.

This basically means that developers have "lesser" floor areas to sell and hence it would mean their profit margins would be eroded.

These changes finally kicked in mid-2023.

I will not bore you with the details but here are the likely consequences from this harmonization of floor area:

- A developer now has less GFA (gross floor area) to work with.

- This means that developers will likely have to lower their land bid prices as they have less sellable areas.

- Because of the perceived "lower" land bid prices, some people are speculating that developers will lower their PSF prices.

But did it happen?

Lentor Mansion's new launch was the first development to be launched under these new rules.

The launch price? $21xx psf. Industry observers says it was "priced sensitively".

Here is my takeaway though: Even if developers secured a lower land bid price, it doesn't mean they will sell to buyers cheaply.

If they can sell with a big fat margin, I am sure they will.

But with these changes on reduced sellable gross floor area which are a pressure on their margins, they will have to maintain their prices.

Don't you think so?

#4: Property Developers Are Subjected To ABSD

Here is another "stressor" for property developers.

They have to sell their units within an allocated period of time - otherwise they will be subjected to ABSD.

Developers have to pay a high ABSD of 30% on the land price if they develop more than 5 units. However, they can get a remission of 25% of the ABSD paid if they sell all the developed units within 5 years of acquiring the land.

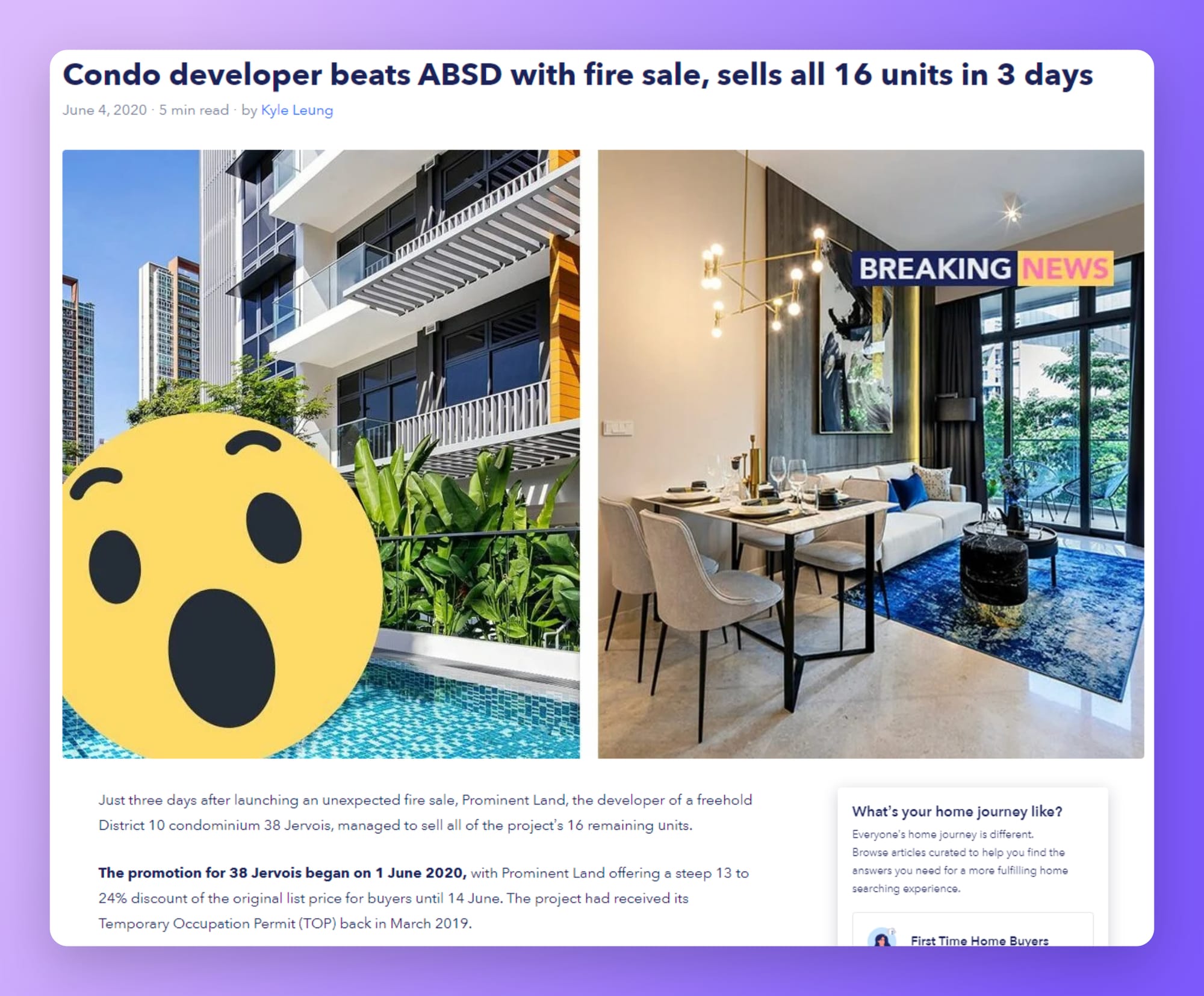

This is why developers like the ones behind 38 Jervois offered significant discounts to homebuyers as they were approaching the 5-year ABSD deadline to sell all units.

Similarly, developers of luxury projects like Hallmark Residences in Bukit Timah, St. Regis at Tanglin Road, and Hilltops in Cairnhill Circle had to slash prices by around 30-50% to sell the remaining units before incurring hefty extension charges under the Qualifying Certificate (QC) regulations.

The QC requires foreign developers to complete construction within 5 years of buying the land and sell all units within 2 years of obtaining Temporary Occupation Permit (TOP).

Failure to do so results in paying extension charges of 8-24% of the land price per year of extension.

So developers are incentivized to offer steep discounts on the remaining units rather than pay the punitive QC extension charges or forfeit the 10% upfront banker's guarantee.

Contrast this to buying a unit from an owner in the resale market.

That owner only has 1 property and has plenty of holding power.

But the developer who is holding on to plenty of units?

They have to eventually sell off every single unit in order to avoid being penalized by ABSD.

That's why developers rather sell out their units fast especially if they feel the market sentiment might not be too favorable for them.

So if you find it hard to buy from a stubborn resale unit owner, perhaps you can consider going to where the supply is?

#5: Property Developers Are Also Fighting For The Same Limited Pool of Buyers

If you analyze who are the buyers of property new launches, you will notice that the vast majority of them are Singapore citizens or PRs.

They are usually HDB upgraders who want to move on to private property.

Most of these buyers are likely to buy a property for their own stay and perhaps considering the potential of capital gains.

But for those who are less concerned about investment returns and can't wait to start the next chapter of their lives - they will be more inclined to purchase their next home from the resale market.

New launches take time to build and usually they will cost more.

Not only that, buyers might have to rent for a few years before they can finally move in.

The resale market can then look very attractive to buyers out there.

For some buyers who are looking for space and are willing to pay for it?

That's where you will see million-dollar HDB flats from private property downgraders who are cashing out. They are likely to be above 55 years old and thus need not go through the 15-month wait-out period.

For this group of older Singaporeans who wish to retire and are flush with cash - it is unlikely they will buy a new launch unit.

Why should they want to pick up another property loan?

That's why, there is only so much buyers available for the new launch market segment.

Conclusion

The private property developers are not a monolithic uniformed group. They each possess their own unique positioning in the market.

They also have their own strategies on how to build the perception of how consumers and buyers view them.

What is clear is that they have to be profitable.

And in order to do that, they have fast to move to secure their own market share.

You imagine if they bought a piece of land for $X psf ppr.

They would do their best to defend that price of that land so that it doesn't drop to a price that is below $X.

And that means buying the surrounding land for >$X psf ppr if they have to.

For us who are not property developers, we can sit back and observe how these industry players plan their chess pieces.

As an agent who closely monitors how prices by developers can change quickly - you can gain an advantage if you know what to look out for.

Unfortunately for those who are not-in-the-know, the final selling price is not so transparent.

You only know the price you are buying only when you balloted and attend the booking session.

But can you still gain an advantage in purchasing a new launch unit?

Yes, of course.

However, you will need to still sit down, crunch the numbers and find the point where you will walkaway and NOT buy.

There is your safe price, your "stretch price" and your walkaway price.

If you are thinking of entering the new launch market this year, I invite you to contact me to do a detailed financial assessment.

Drop me a message via WhatsApp.

There is no obligation to take action after our discussions.

Member discussion