Is Your Property As An "Alternative" Bank Account? Here's 3 Ways To Look At It

In Singapore, we have high rates of property ownership.

I think this is part of our Asian identity - we believe in ownership instead of renting.

When we take a mortgage loan, our monthly payments can be considered as going into 2 different containers:

- cost of the loan known as the interest

- the principal - which goes as part of our equity and ownership

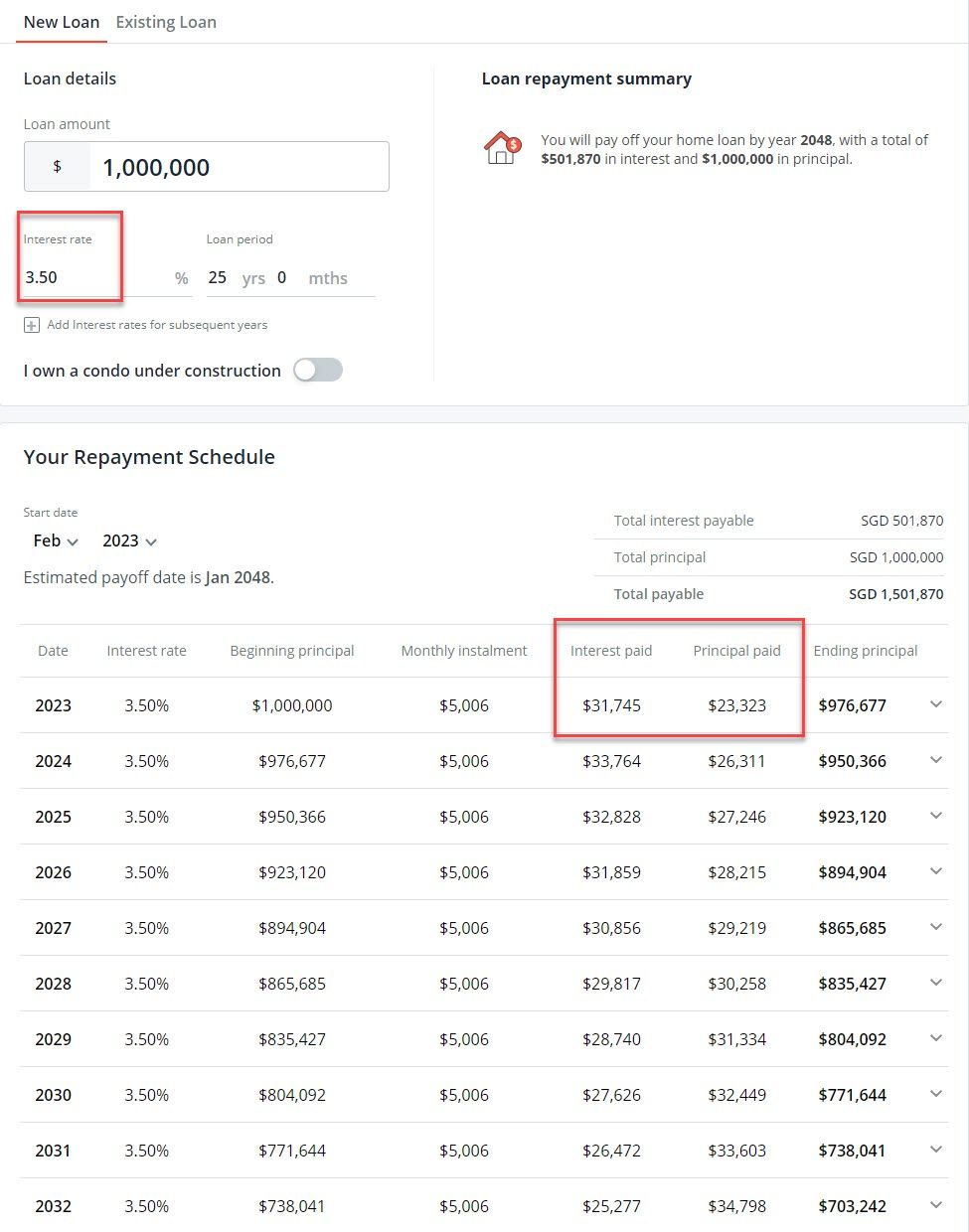

Here is an example of how a $1M property loan with a 3.5% interest rate is paid off.

To take a $1M loan, it usually means the property is worth $1.33M at least.

As you can see, at the beginning of the loan tenure - the interest paid is higher than than the principal paid.

The bank has to make money too.

To me, I see this as a cost of leveraging.

Banks would not loan money to me for other forms of investments. But for property, they will.

Because of this equity we are able to get back if we make the decision to sell the property - most of us will view our our home as an alternative bank account.

Here I share another 3 ways to view your home and property loan.

#1: Your Property Is A Form of Locked Paid-Up Capital

If we extend the meaning of being an "alternative" bank account, we can consider our property as a form of paid-up capital.

The monies we paid is locked there and we don't have free and easy access to it. Is this good or bad?

In this case, it is very good.

There is this alternative form of savings that we can't touch so easily.

It also provides a roof over our heads and a place to create memories with our loved ones.

We can view it as a cost in the meantime - just like our utility bill.

But unlike our utility bill which is irrecoverable, there is still a chance for us to recover back the payments made eventually - when we decide to sell.

#2: The Larger Your Paid-Up Capital, The Larger Your Runway

For my family, we made the decision to increase our "paid-up capital" for our property.

From a $500K HDB flat, we made the shift to purchase a $1.7M 3-bedder private condo.

Our "paid-up capital" has increased by more than 3 times.

What is the added advantage of taking a bigger loan?

Why put ourselves through unnecessary stress?

The main reason is simple.

A larger paid-up capital means we have this much larger amount to "play" with.

At the end of 25 years, we have a fully-paid up property that is worth about $1.7M - give or take.

Sure, there might be some depreciation.

Even if it depreciates to $1.5M, it still 3 times larger than our previous $500K HDB.

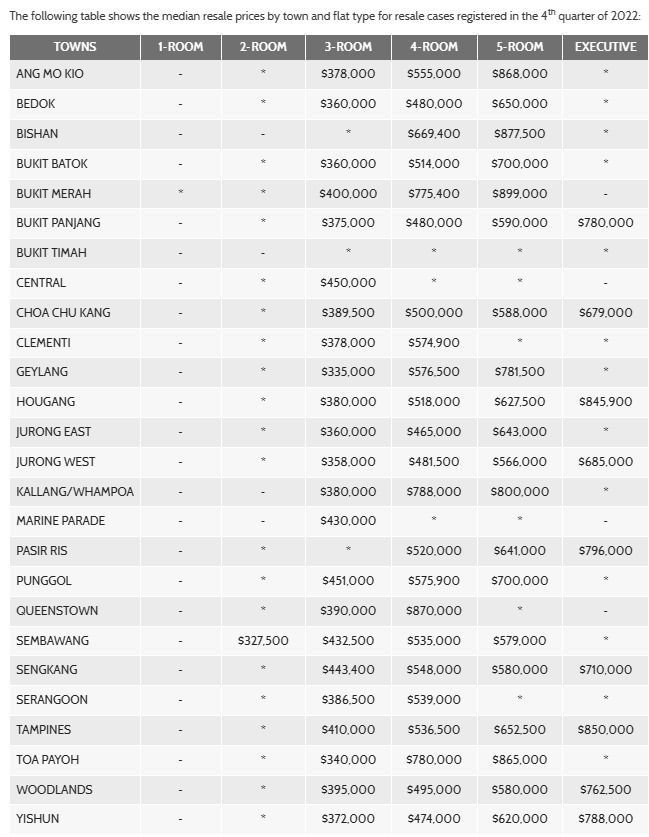

And if we have to downgrade, it is far easier to downgrade from a $1.5M property to a $1M property in the future.

Compare that to a $500K HDB - the "runway" for downgrading is only so much. Does it mean a downgrade from a $500K HDB to a $200K HDB in order to unlock our monies for retirement?

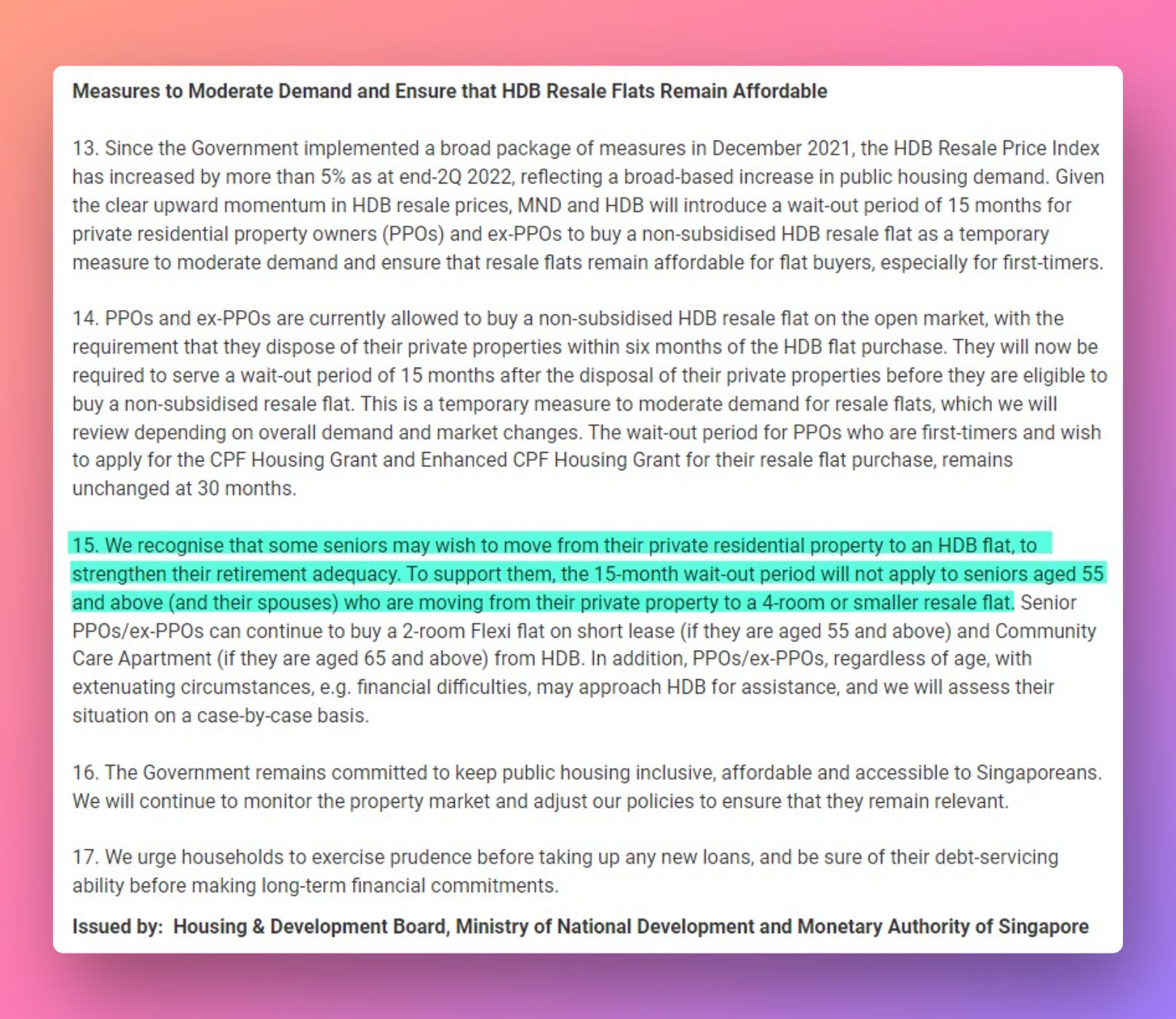

Take note, the government seems to recognize "downgrading" as a path to supplement our retirement.

If you take a look at the 30 Sept 2022 cooling measures, they added in this paragraph which I highlighted.

They actually made an exception for those private property owners who are aged 55 years old and above.

They are allowed to downgrade to a 4-room HDB flat or smaller.

So by starting off with a larger "paid-up capital", it provides us with more options in the future.

A $1.7M or $1.5M starting point gives us more property choices that we can consider once we are on our retirement paths.

- $1M smaller property?

- A $500K 4-room HDB flat?

- A $300K 2-room HDB flat?

Instead of having limited options as we approach retirement age, the possibilities for us is that much wider.

If we want to cash out more, then we take a lower-priced property.

The idea of downgrading is now a much more comfortable proposition.

What's most important is that we don't have to rely on our children for retirement.

South Asian children feel pressures to look after ageing parents, says the writer, who is supporting his parents through their retirement.

Posted by The Straits Times on Saturday, February 4, 2023

#3: Manage Expectations By Viewing Capital Gains As A Bonus

The simple fact of life is this: Everything costs money.

Your

- Coffee

- "Cai Png"

- Car

All of the above costs money.

So by right our home - it should also cost us some money.

But somehow in recent years - we been believing this idea that we should stay in our homes for free and make money at the end when we sell.

While I believe making money from property is possible as I have done it for myself - it is not always true for everyone.

We can take a more measured and conservative view that any capital gains we make as a bonus.

The main reason why we can reap capital gains is because we:

- selected the right property choice at the right time

- we rode the economic growth while we stayed in the property

Moving forward, Singapore's economic growth might not be as significant.

Even for my own property choices, we were lucky in the sense that the pandemic happened in 2020 which pushed up the overall property market.

Rentals of private homes jumped to hit a new high and tenant budgets are stretched to new limits, said one property analyst.

Posted by CNA on Thursday, October 27, 2022

I recognize that not everyone will have such luck.

So let's do our best in working with what we have and what we can control.

In this case, it is our own paid-up capital.

We can also choose to manage our expectations.

We hope for the best but we prepare for the worst.

Conclusion

Our property is a slightly different form of investment vehicle.

It can be an incurred cost that is unavoidable as we all need a roof over our heads.

But there is also an opportunity to unlock our cash and regain it back. And that gives us an edge if we know what to steps to take next.

Imagine...

If we know when to let go and sell our underperforming property to exchange for another property that has even better performance.

Of course, this is not suitable for everyone.

Even if you decide to sell, you need to know what is the next suitable property for you.

If you have questions, I invite you to contact me for a no-obligation discussion.

Member discussion