Million Dollar HDB Flats: My Perspectives as a Parent and Self-Employed Agent

Million dollar HDB transactions have been dominating the headlines recently.

It did not help that recently a 33-year old Bishan EM was recently sold at a record-breaking price of $1.45M.

I am not just a property agent.

I am also a father of 2 boys.

And like most parents out there, I too am concerned about how the prices of HDB flats are rising and whether my own children can afford it in the future.

My Perspective as a Parent

As a parent, the last thing I want to do is depend on my kids to support me for my future retirement. I want them to lead their own lives and be as independent as possible.

My goal is for them be as self-sufficient and self-reliant.

Be able to stand on their own two feet.

And so, my responsibility as a parent is to make sure they receive the education and life lessons they need so they can survive and thrive in their own futures.

What I really want to do is actually to wish them "All the best, good luck and bye bye!" and close the door. 😂😂😂

They are boys who will hopefully grow up to become good and fine young men.

So I have no big goals of leaving a lot of assets for them.

However, they are also my own flesh and blood.

And that's why I will try to leave something behind which can provide them with some distinct advantages.

Assets like money and property? Not so much.

But what I will do is focus on making sure they are equipped with life skills that are not always measurable like resilience, an attitude of self-responsibility and a positive mindset.

Is this going to be easy?

Definitely no. But it can be inculcated when we start them young.

My Wife Is The Best Example

One of the reasons why I am confident about developing good values for my children is because of my wife.

She developed her career in a male-dominated engineering industry and slowly climbed up the corporate ladder by identifying her strengths and skillsets early on.

Despite being a mother of 2 boys, she continued to develop and upgrade her knowledge to become part of higher management.

Today, she holds a relatively secure technical management position within an MNC that is not likely to be hit with layoffs anytime soon.

She regularly networks with her ex-colleagues and checks in regularly with peers within and outside the industry.

If she does seek another role, it is likely to come from these connections.

I admire her ability to deliver on her KPIs, ensuring her visibility within the company ranks, manage office politics and being a mother - all at the same time.

It is not easy.

My job is to make sure my boys notice it and learn to pick up the lessons to apply in their own lives.

My Perspective as a Property Agent

Perhaps you might think all agents are "huat" because of the rise in property prices.

Personally, I do not really look forward if prices rise too quickly - it can become dangerously speculative.

It does no favors for me (nor to anyone) if the market implodes due to speculation.

But if you really study the government's moves - it is all designed to cool down the property prices without rocking the market too much.

As a property agent, I can sense that the government is doing their best to make sure HDB prices remain affordable.

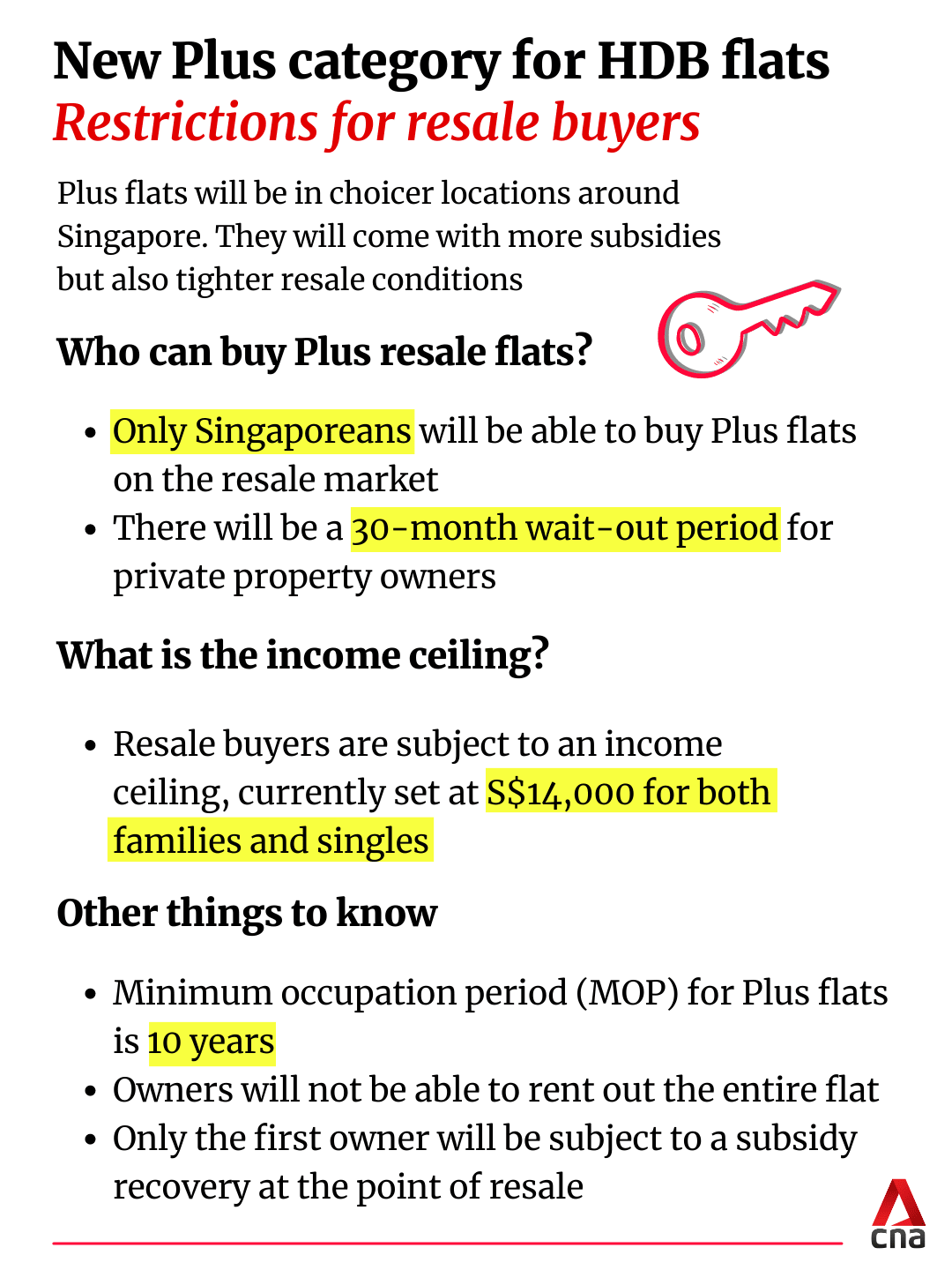

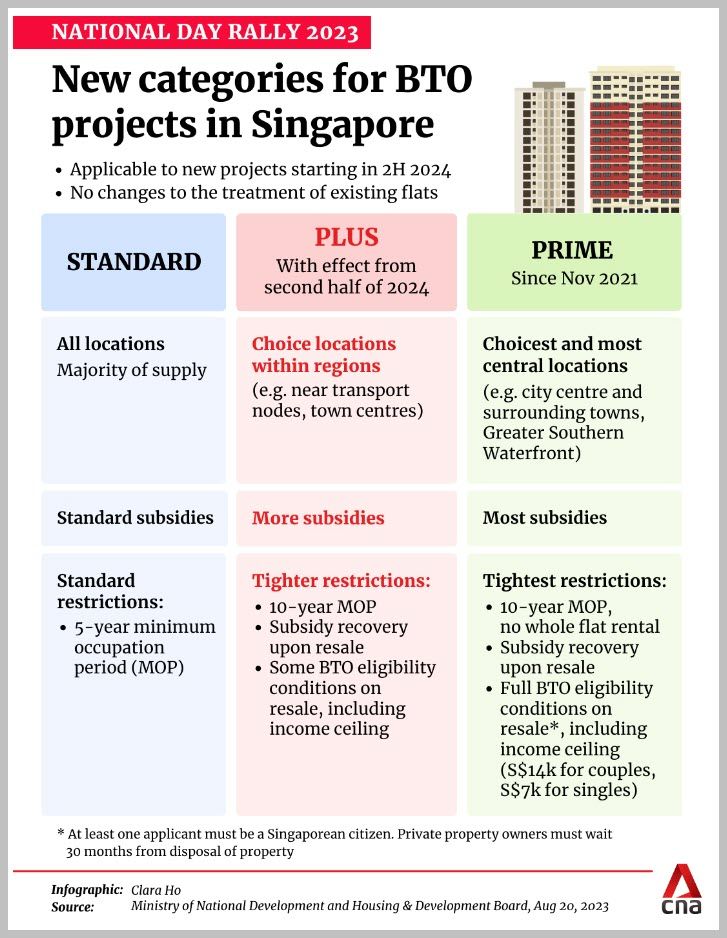

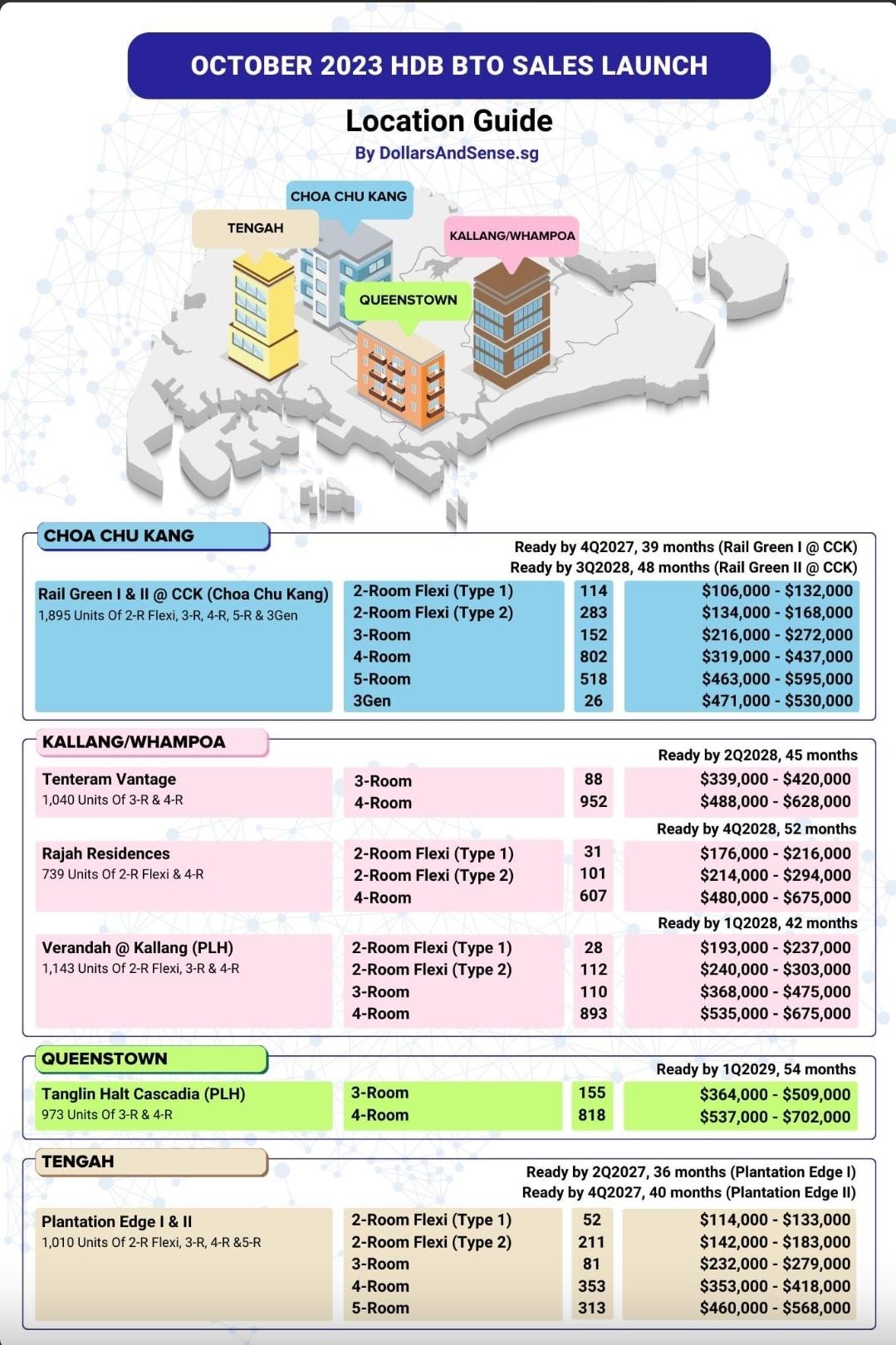

They have noticed that people are balloting for BTOs in good locations and that's why they launched Prime and Plus housing models.

They even increased the Minimum Occupation Period (MOP) to 10 years to discourage flipping.

All these are good moves actually which are trying to slow down the growth of property prices. But we also have to acknowledge and understand human behavior.

Who doesn't want to make money from property if they can?

So the government is doing their best to discourage it - to the extent of even clawing back some of the profits made from selling PLH units.

The "Missing" 5-Room Flats

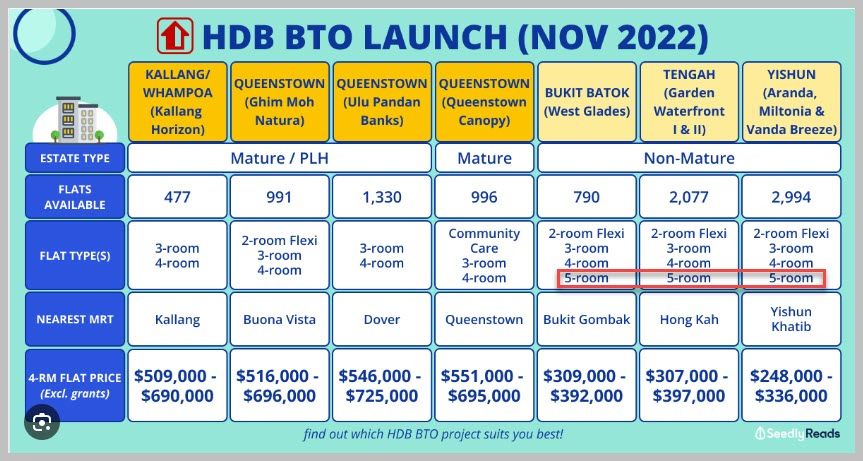

If you monitor the various BTO launches, you will notice that 5-room flats are usually not present in those estates near the central region.

My purely "speculative" thoughts?

I think it is because the price will be outside a certain affordable range. In AMK, the 5-room BTO flats were already being launched at prices between $713K to $877K.

I am quite confident that by the time these 5-room HDB flats hit the 5-year MOP, they will be sold at $1M or more.

I believe as the need to build more BTO flats increases, size will become a premium.

5-room HDB flats, EM and EAs will become more and more sought after.

This presents an opportunity for 4-room HDB flat owners - you should consider upgrading to a bigger HDB flat if you wish to have a property that can retain its value better in the long run.

That being said - do consider the remaining lease of the flat as well due to lease decay issues.

Who Are the Buyers of Million Dollar HDB Flats?

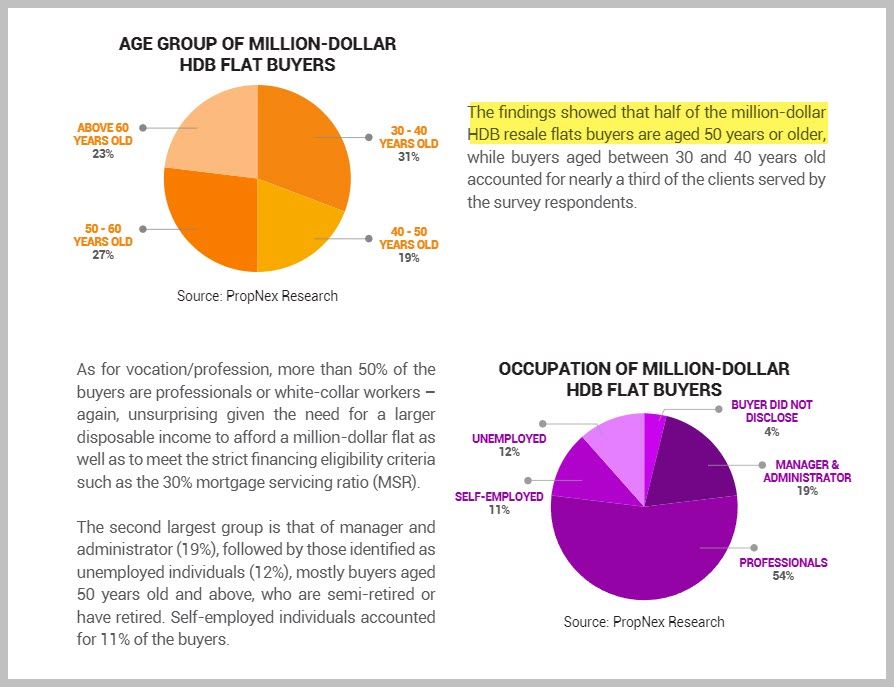

Being the largest agency in Singapore, PropNex has the data on who are the buyers of these million dollar HDB flats.

You can access the full report here: https://www.propnex.com/reports/56/million-dollar-hdb-resale-flats

But here is the main gist:

Half of the million-dollar HDB flat buyers are aged 50 years and older.

From my discussions with fellow agents who have transacted these deals, they are usually private property downgraders.

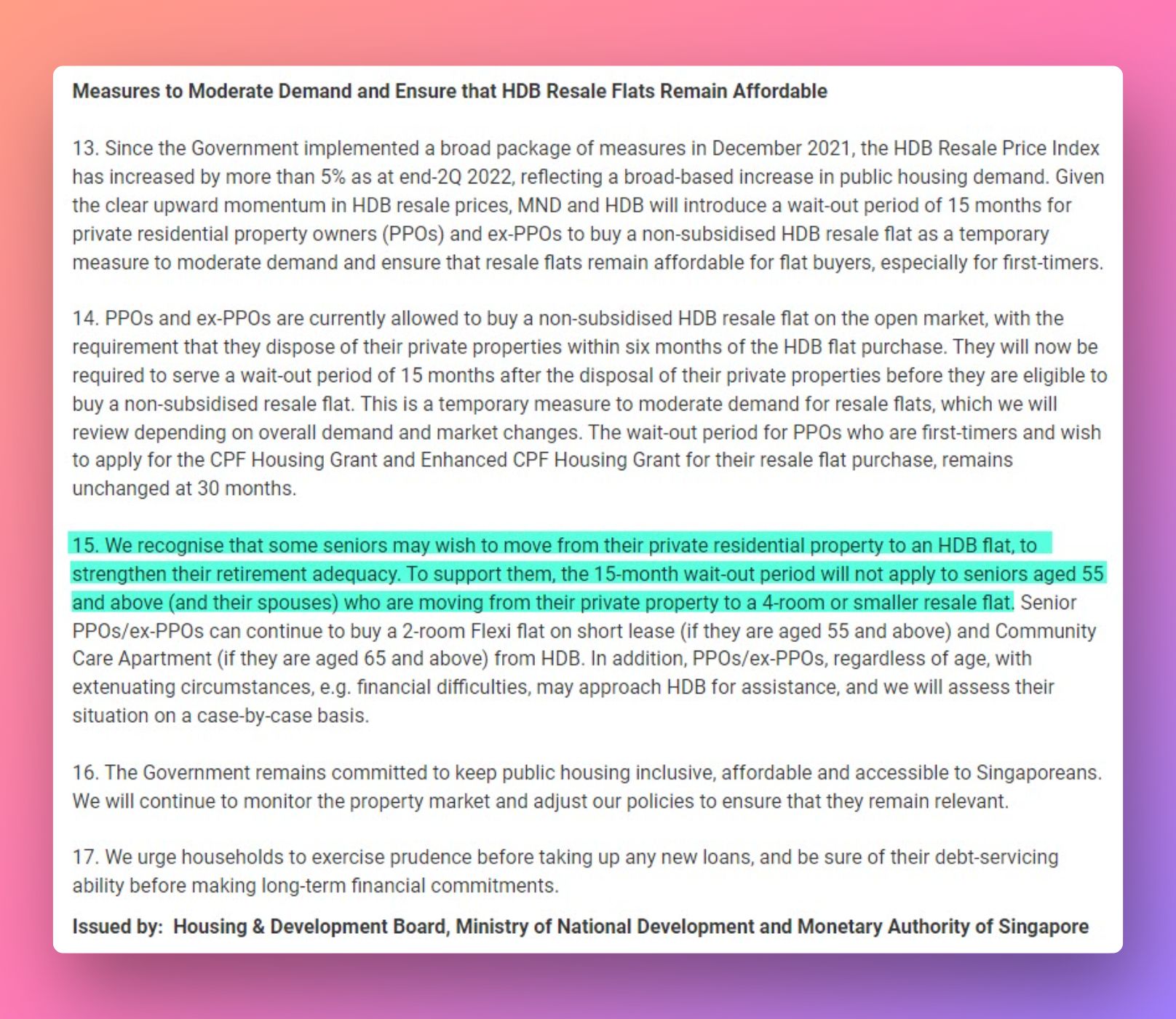

If you recall the 30 Sept 2022 cooling measures, the most dramatic one was when private property downgraders were "banned" from buying HDB resale flats for at least 15 months.

But there is something interesting about the "exceptions" allowed.

Private property downgraders who are 55 years old and above were exempted from the 15-months waiting period.

I wrote about this in greater detail here: https://www.dreamhomewithmartin.com/property-as-an-alternative-bank-account/

The Future Belongs To The Competent

In my previous article "Are You Feeling Priced Out of New Launches?" - I shared about how overall incomes are rising in Singapore.

Right now, I am competing in a highly-competitive industry with over 30,000 property agents.

I think I am allowed to say that the property market is a stern taskmaster.

My earning ability is largely determined by the market's perception of excellence, quality, and value that I can provide to others.

It pays average rewards for average performance, and it pays below-average rewards (or unemployment) for below-average performance.

It’s not personal; it’s just the way our economy works.

And this is something we must keep in mind as we live in a country like Singapore.

There is this quote from the famous speaker Jim Rohn about pain:

We must all suffer from one of two pains: the pain of discipline or the pain of regret.

The difference is that discipline weighs ounces while regret weighs tons.

Conclusion

The way that Singapore is designed - it has to compete in the global economy and thus remain attractive to investors and businesses.

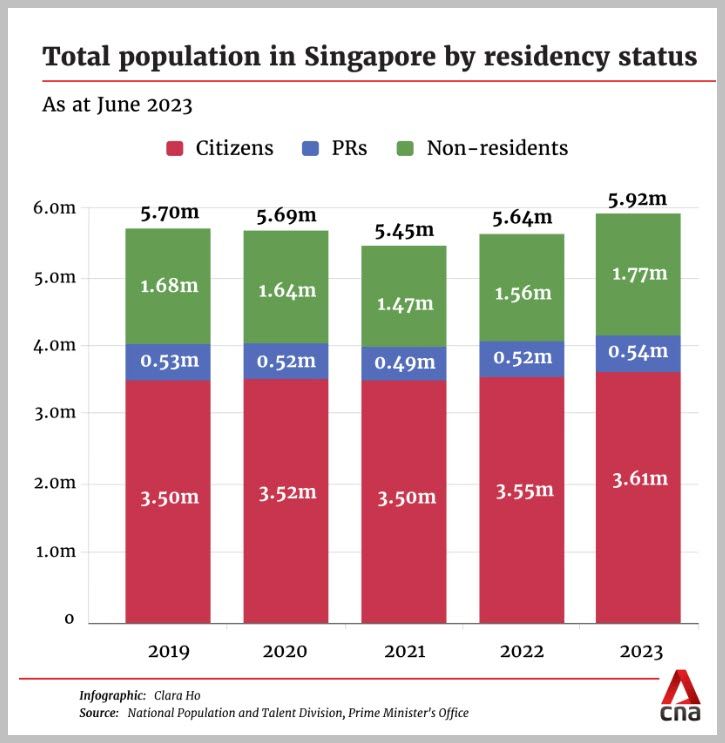

In a country with declining birth rates and lowest TFR on record, our total population is still increasing.

My two cents worth?

I think we need to acknowledge that with population growth, property demand will remain robust.

But we need to do the hard and difficult things now - so our older self can thank us.

What am I doing today is that is so that my older self - that 80-year old person in the mirror - can say "thank you for taking care of me."

It is very similar to how we take care of our body now - we don't wait for our body to fall apart before we start trying to be healthy.

I try to frame this a a form of stress that pushes me to step out of my comfort zone in order to progress further in life.

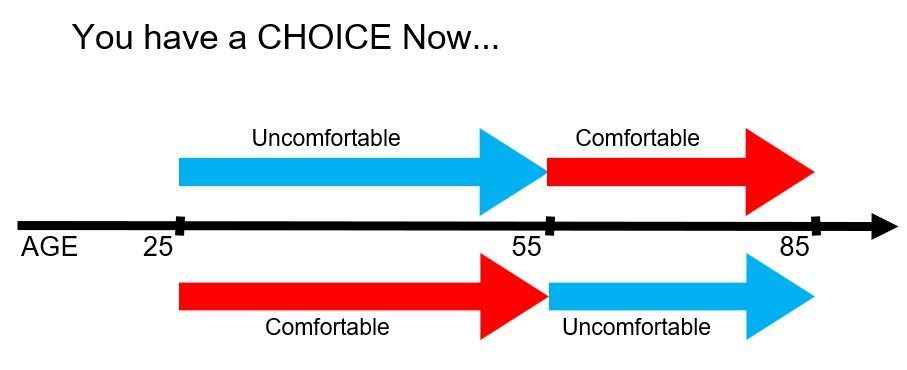

That's why my wife and I made the decision together to switch over to private property - it provides a path for us to secure our retirement through property.

We know it is going to be hard.

But we embarked on the journey anyway for the options it will provide when we hit 55 years old.

We know it will be far easier to downgrade from a private property to HDB - rather than from bigger HDB to smaller HDB.

Will we do it? I am not sure.

But that option is available to us if we need it.

Life in Singapore will remain challenging with rising costs of living.

But we can acknowledge that when something is difficult, we can choose to perceive it as a challenge to ourselves and not a threat.

If you are interested to have an honest appraisal on what is possible for you and your family in terms of property options, contact me to arrange a no-obligation discussion.

Member discussion