Increased CPF Contributions In 2023 - Here are 5 Takeaways

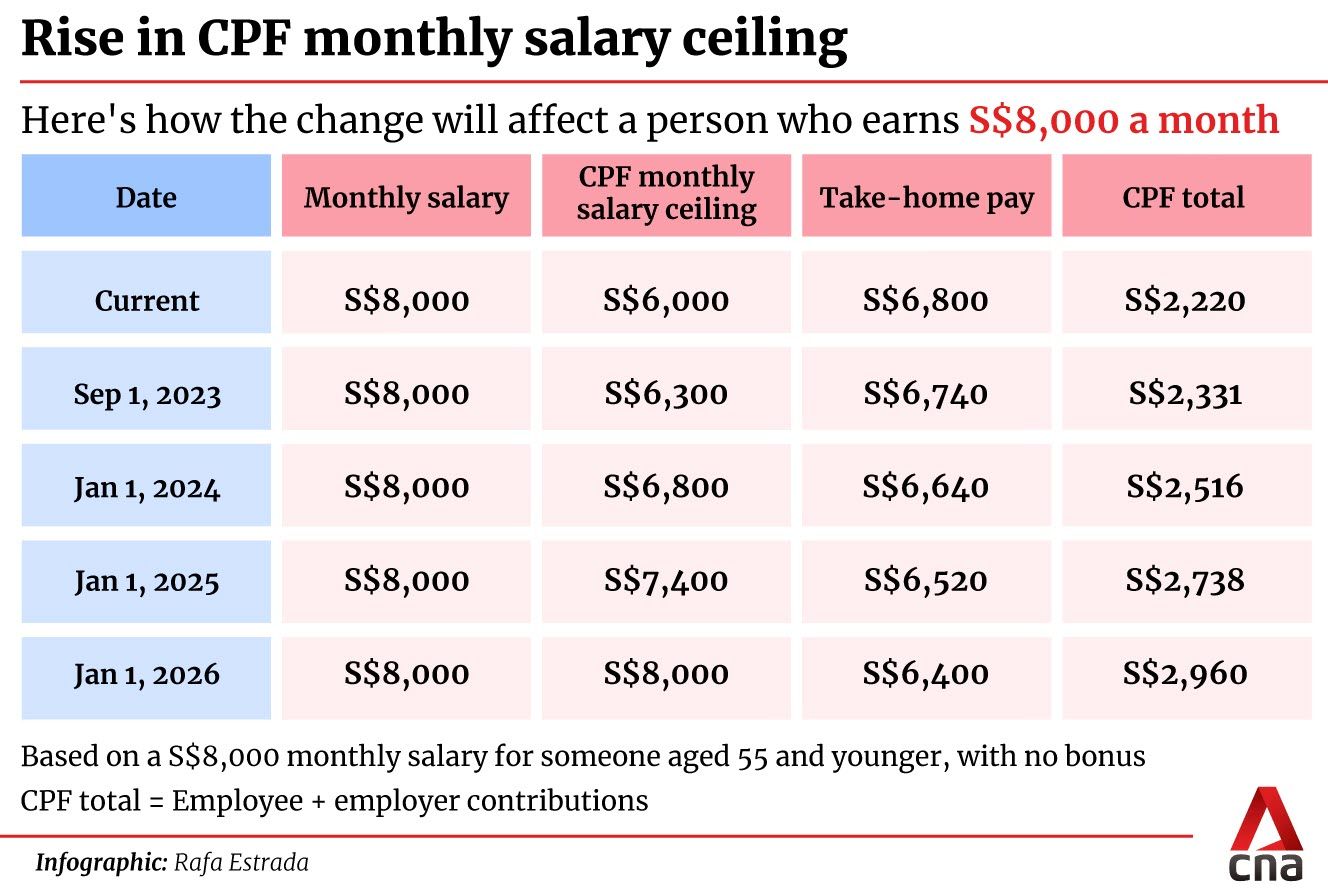

On 1 September 2023, the CPF monthly salary ceiling will rise progressively and reach $8,000 in 2026.

It is currently set at $6,000.

If you are earning more than $6,000 a month, your take-home pay will become lower as a result of the increases in the CPF monthly salary ceiling.

This is because of the additional employee CPF contribution you must make each month.

At the same time, your employer must also make more CPF contributions if your salary exceeds $6,000 a month, capped by the prevailing ceiling.

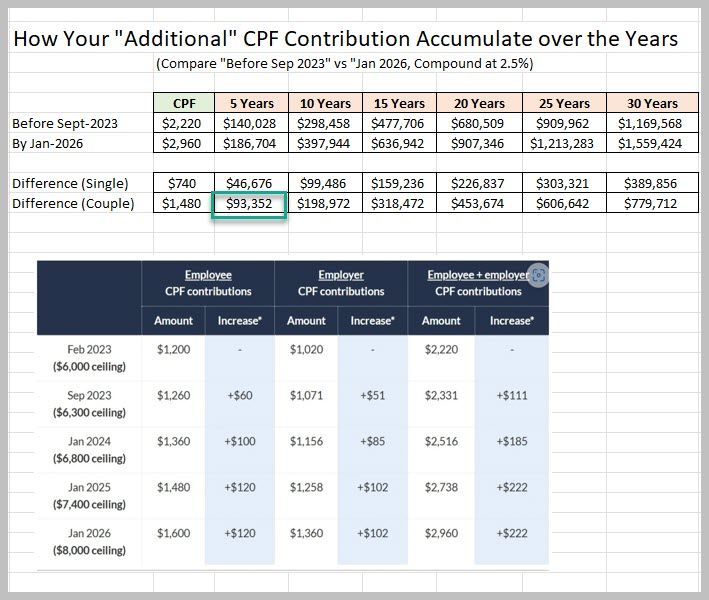

If you see the above chart, you can see your:

- take-home pay will be decreased gradually while

- your CPF contributions will be increased gradually

However, if you are below the salary ceiling of $6K, you are not affected.

Someone who is earning $4K will have no change to their CPF contributions.

In this article, let's explore what it means if we read between the lines about the above changes means.

Here are 5 takeaways we can consider:

#1: Indirect Increase of Salary

For those who are earning more than $6K, they will notice that their take-home pay will be reduced. In the example of the $8k income earner, the take-home pay is reduced by:

- $60

- $100

- $120

It is a gradual decrease but within 4 years, the take-home pay is reduced by $400 for the $8k income earner.

But there is also an increase of $740 to the CPF contributions.

So there is an indirect increase of salary - but it goes to your CPF accounts.

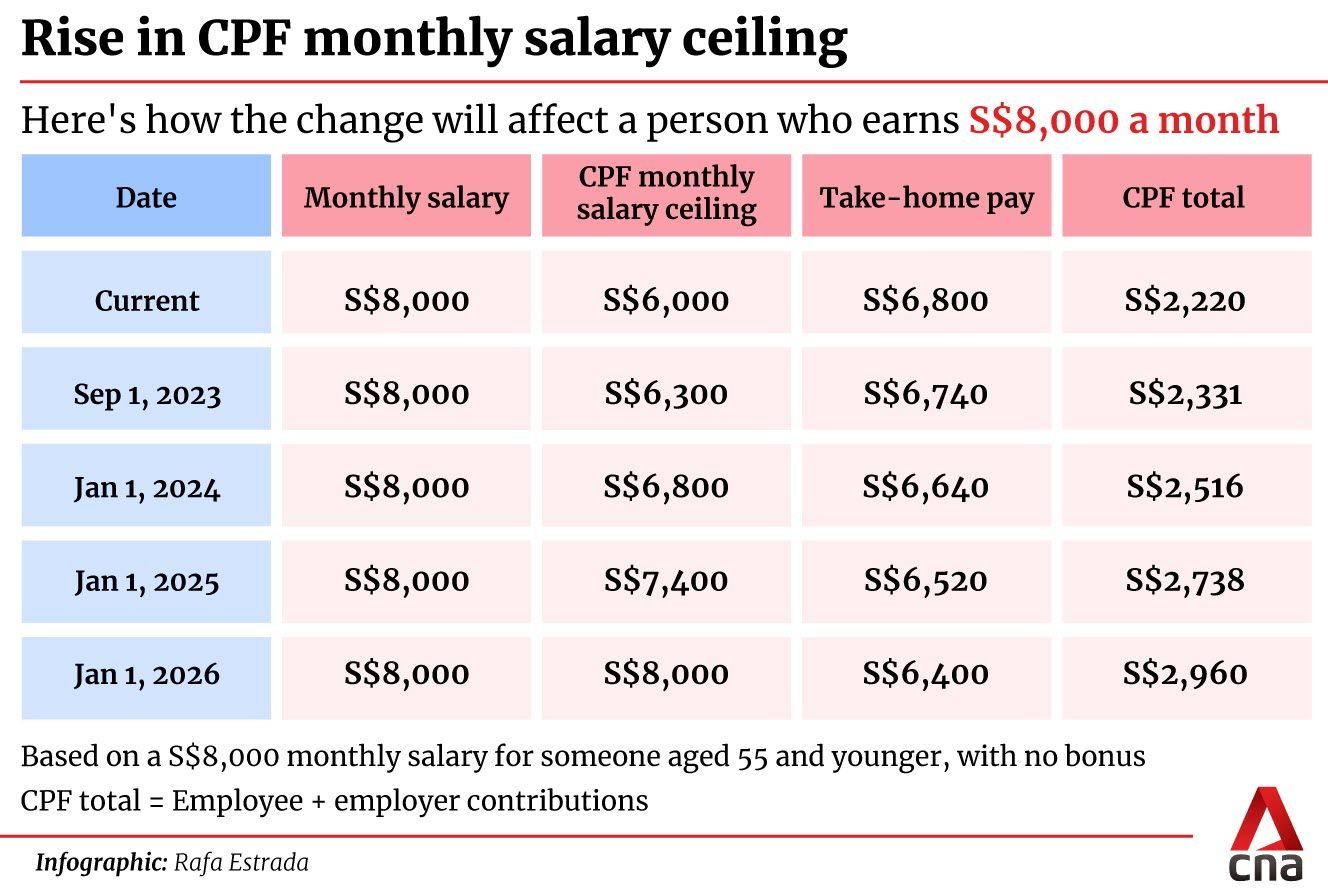

When I read through the Budget 2023 statement by Finance Minister Lawrence Wong, he highlighted that it was to help Singaporeans save more for retirement.

#2: Increase Retirement Needs

If you read through the entire statement here, you will notice the concerns the government have on retirement adequacy.

There seems to be a strong push to ensure the elderly have enough to support themselves for retirement.

I've been reading headlines from the news recently about retirement topics since the news of the Budget recently came out.

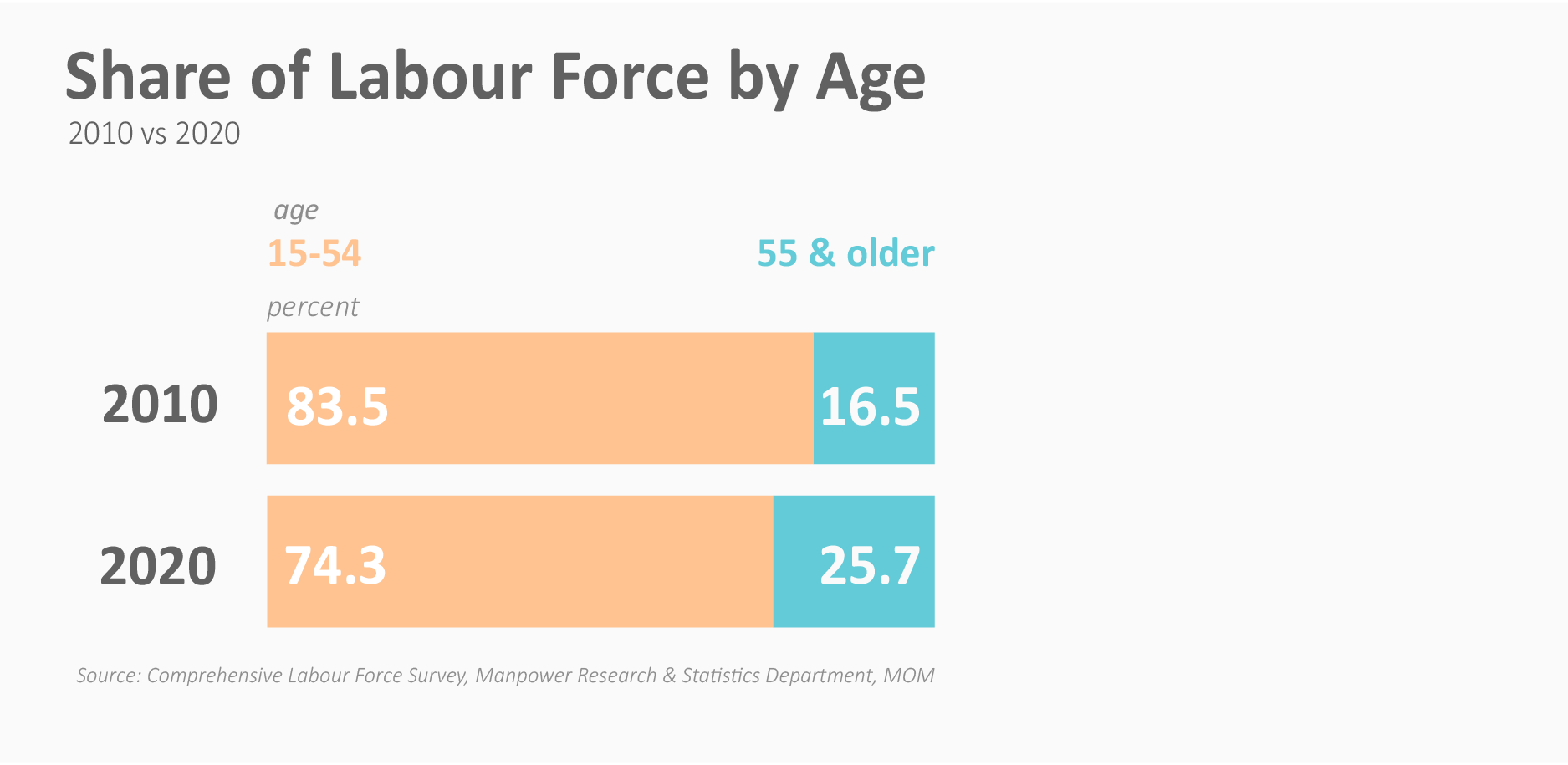

According to the Ministry of Manpower, around 1 in 4 of Singapore’s resident workers is aged 55 and older as of 2020.

They are also taking up a bigger share of our labour workforce.

The government is also planning ahead with 8 new nursing homes in the next 5 years.

All this means it is necessary to take into consideration of the "grim reality of aging" as mentioned by PM Lee.

#3: Anticipation of higher costs of living from inflation

The government is known for planning ahead.

In this case, mandating Singaporeans to put more cash into their CPF seems like a hedge for rising costs of living in the future.

With the guaranteed 2.5% returns from CPF, this helps to secure a bigger retirement nest egg for Singaporeans retiring in the future.

2023 is already shaping up to a period of high inflation and we are not sure when things will go back to "normal" - despite the Federal Reserve increasing the interest rates.

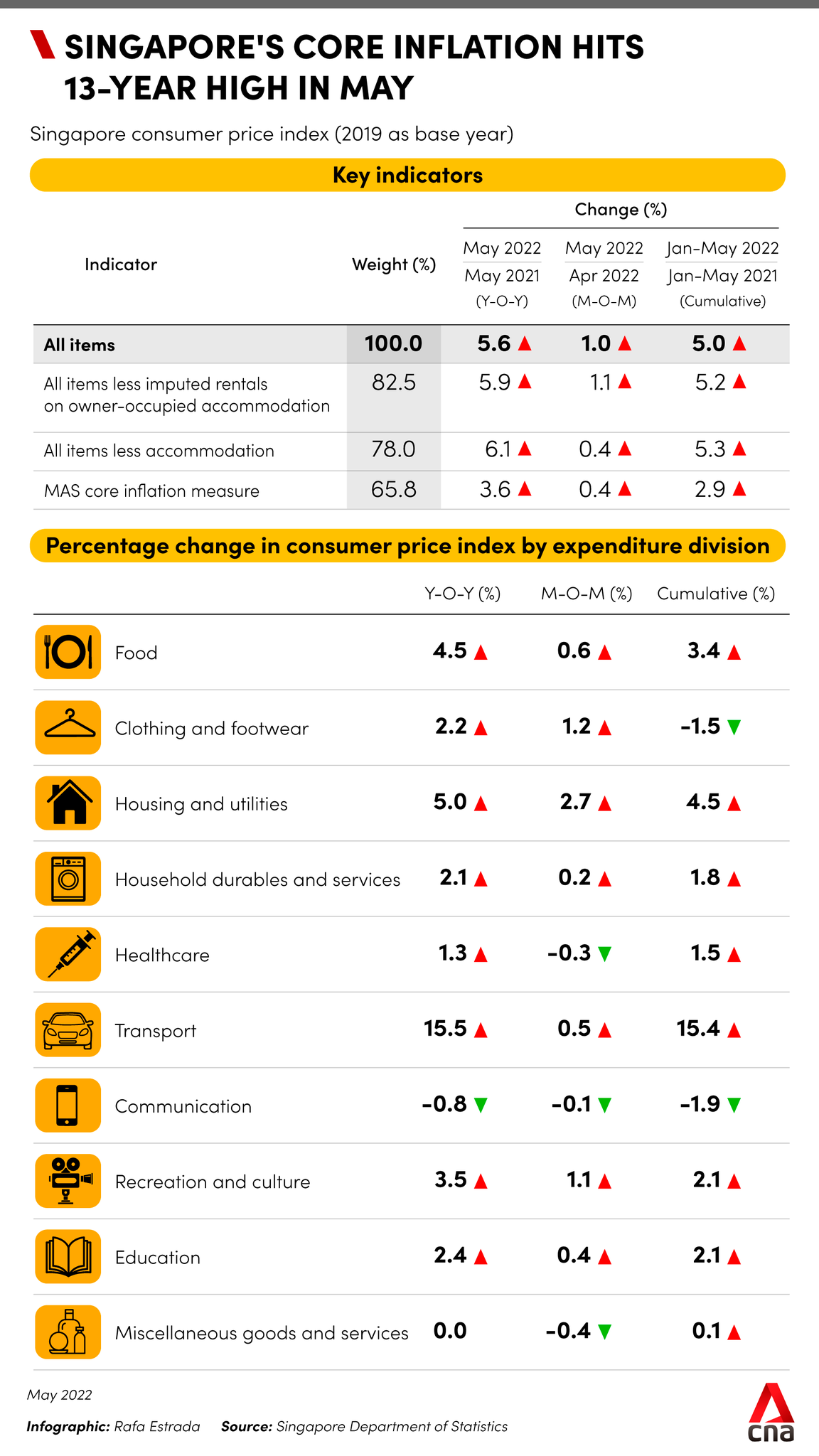

We are in a period where 3.8% inflation rate is considered "low".

Core inflation had risen to 5.5 per cent in January and February this year, a 14-year high, before trending downwards in the following months.

What does this mean?

It means if our salaries have increased by less than 5.5%, it means we essentially had a pay-cut this year. And that's why our CPF contributions have to be increased.

#4: Anticipation of higher property costs?

With more monies in the CPF accounts, it also means there is more funds available to pay down your property.

Assuming an increase of $740 in monthly contributions, this means you can afford an additional property cushion that amounts to $94K.

This is assuming 2.5% interest for 5 years for the CPF contributions of a couple who is earning $8k each.

Currently, BTO flats in AMK Weave is already being sold as high as $877K.

Assuming these BTO flats are the first property of most Singaporean couples, it also means they have to meet the necessary criteria to own these flats.

This means they also need to meet the criteria where the household income is below $14K.

Without increasing the income ceiling and yet allowing more CPF contributions, it means giving couples a chance to build up their CPF monies to purchase these flats.

#5: Support In the Servicing of the Property Mortgage?

What is clear that in the post-pandemic period is we are entering a period of high inflation.

Costs have risen across the board and that includes housing.

At the same time with interest rates on property loans rising, this also means forking out more monies towards the monthly mortgage payments.

With more monies available in the CPF tank, homeowners have less stress on servicing their monthly mortgage.

Conclusion

On the surface, it looks good as we are essentially being asked to park more monies for the future into our retirement funds.

But on the other hand, it also takes away cash on hand that can be very helpful in the times of high inflation like today.

In any investment, it is essential that we take a long-term view and see the increased CPF contributions as a form of forced long-term savings for the future.

As seen in my calculations above, someone with $8k monthly salary can build up a substantial additional CPF cushion just within a few years.

The heart of the matter is we need to find ways to improve our investment returns as inflation and rising costs cut away any gains we make.

What do you think?

If you wish to access the spreadsheet above to calculate your accumulation of CPF monies, just drop me a message via WhatsApp.

Member discussion