HDB Upgrading Is a Journey. Here Are 5 Observations From Selling Off Our BTO And Buying 2 Private Condo Units.

As a born and bred Singaporean, I have been aspiring after the upgrading dream for the longest time.

Even before our flat hit the 5-year MOP mark, I have been doing my research on how possible it was to turn our BTO as a starting point to grow our wealth.

A lot of discussions with my wife as we considered the logistics of moving, the financial challenges and also considering other alternative plans.

If Plan A does not work, what was going to be our Plan B?

With both HDB and private residential property price indices on an uptrend, is this a good time for HDB owners to...

Posted by EdgeProp Singapore on Thursday, November 4, 2021

Observation #1: We Planned Ahead & Executed Fast

I remembered our initial plans was to go for a resale condo unit.

The main reason was we didn't want to go through the trouble and costs of renting.

So we actually went to explore different areas around Singapore to check out various condo units that was up for sale.

At this point, we have not yet sold our HDB flat but we were already "window-shopping". Interesting ya?

But she couldn't find an area or a unit that was appealing to her.

Between both of us, location is far more important to my wife due to her work.

Then we started to check out new launches.

I think we visited at least 8 different showflats.

At this point, we have already sold off our HDB flat.

So perhaps there was some pressure on us to quickly make a decision?

For some reason, she had an affinity to Park Colonial and made up her mind quickly to go for this.

We agreed to liquidate a portion of our paper investments to proceed with the downpayment.

Observation #2: Why We Chose Park Colonial

I've been asked a few times why we chose Park Colonial when there were many other similarly priced new launches during that period.

The main reason hands down was accessibility and convenience.

We wanted a place that we can rely heavily on public transport - one that allowed my teenage children to go to school by themselves.

During that period, Park Colonial was launched at at $17XX - $18XXX PSF while The Woodleigh Residences was being sold at $2XXX PSF.

So in terms of price, Park Colonial was more attractive compared to the Woodleigh Residences as it meant a savings of about $200K.

It meant an additional 2-minutes walk home from the MRT but I think it is worth the savings.

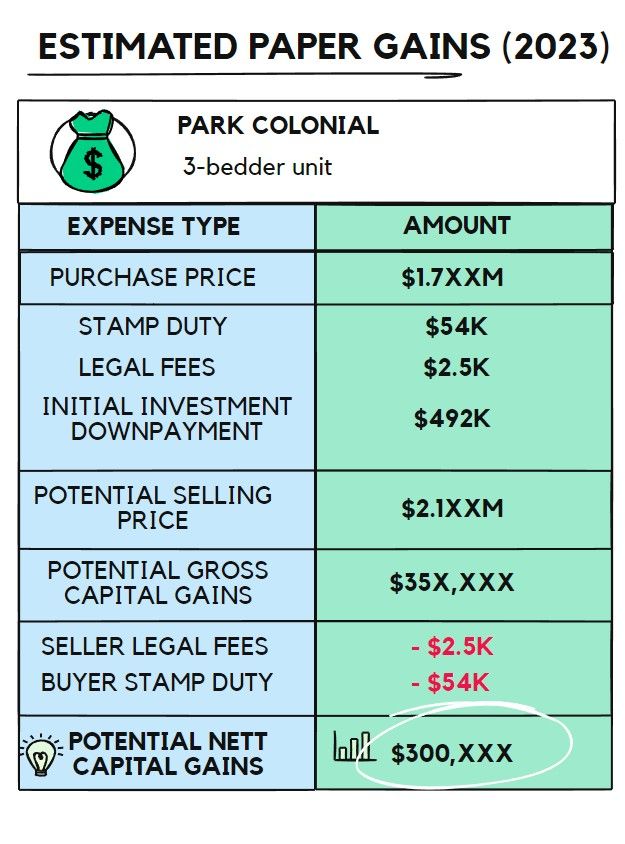

In August 2018, my wife proceeded to book a 3-bedder unit under her own name.

A month later, I booked a 2-bedder unit under my own name.

We have officially kickstarted the journey of property upgrading!

Observation #3: We Rented For 4 Years

We made arrangements to rent a 4-room HDB flat after we sold off our 5-room HDB flat.

I remembered making a conscious decision to rent a smaller flat so we could get used to the smaller space.

It was an adjustment we all had to make as a family.

It was not so easy at first as we disciplined ourselves to not clutter our place and try to live a minimalist lifestyle.

Being a tenant during that period was also a mindset adjustment as we have to live by the rules of the landlord.

Overall, we spent about $120K in rental monies. Was it worth it?

Some might argue that this was a cost - an expense that we couldn't get back.

But had I bought a resale unit for us to move in immediately, it would have cost more in terms of interest rate costs. Also, it will not allow for flexibility and options as we are essentially stuck with a resale unit for 4 years.

With a lease, we could choose to have a change of scenery once the lease is over.

An option to be more "nomadic" so to speak.

I also wanted to own an investment that will grow in parallel during the construction period.

It was really my chance to experience and participate in the capital growth of a new launch development and I didn't want to miss out.

Plus with a new launch - the majority of the payments will still go to principal, as the interest rate was still low.

Observation #4: Do It When Our Kids Are Young & Adaptable

One of the things that I appreciate during the upgrading journey was the fact that our children were adaptable to the changes.

In 2022, my younger son was going through his PSLE year.

So we held off moving to Park Colonial until he completed his final exams. But once it was over, we packed up our belongings from the rental unit and moved in within a month.

Actually when I speak to my kids about moving to another place, they did not ask too many questions.

Maybe boys can be slightly indifferent.

They actually transited from sharing a room (in our BTO flat and rental period) to finally, having their own room (in our Park Colonial unit).

We sometimes like to use our children as reasons to not proceed with a big decision.

But the truth is we use our children more as an excuse rather than the real reason.

For me and my wife, our intuition tells us this decision to let go of our HDB and upgrade will benefit the whole family in the long run.

There will be challenges no doubt.

But it was also good for our kids to observe what we adults do to tackle these challenges. Practice what we preach.

As parents, we ask our kids to rise up and be resilient.

It is only fair we do the same.

Observation #5: Inflation is the Silent Killer

When we entered the private property segment, interest rates were very low.

Almost zero.

Banks across the globe have been bearing the brunt of record-low interest rates.

Posted by CNBC International on Tuesday, October 22, 2019

I remember the common complaint during that period was about how keeping money in the bank was useless - it needed to be put to work in order to generate better returns.

Then the pandemic happened.

Every stimulus measure that could be done... was done to keep the economies of the world going as people stayed home and lockdowns happened.

2 years later, we now face one of the highest inflation rates on record.

Due to rapidly rising interest rates, potential homebuyers can no longer afford homes that they could have purchased last year.

Posted by CNBC International on Tuesday, July 26, 2022

There are consequences to every action.

Today, we see the prices of items everywhere rising up.

Especially property.

Reflecting back, we are glad that we were decisive enough to take action to purchase not just 1 but 2 units at Park Colonial.

Looking at how the prices have risen today, I am not sure we would have been able to buy 2 properties now - had we chosen to delay back in 2019.

Conclusion

Some people will think that what we did was silly - sacrificing our comfortable home and paying significant rent just for the dream of pursuing property upgrading.

But as an agent, I also have heard stories from another group.

Those who admitted that they were too timid to pull the trigger and take action during the oversupply situation of 2018 to 2019.

69% of developers surveyed foresee a serious over-supply over the next one to two years, and 60% of survey respondents indicated aggressive bidding as a possible cause for over-supply

Posted by EdgeProp Singapore on Wednesday, January 24, 2018

In 2022, they felt they missed the boat and the opportunity to make good returns on property investments especially in a situation where there is a double whammy of:

- rising interest rates (the era of cheap loans seems to be over)

- rising inflation (the costs of raw materials and labour are steadily going upwards)

For me, part of the reason why we proceeded with this upgrading journey was also this:

I wanted to make sure that I am practicing what I preach.

How could I provide useful insights to others if I never done it myself?

Hence that is the reason why I am taking the time to pen down this entire journey.

Was it easy? Definitely no.

Would we do it again? Yes.

The onus is on us to achieve our financial goals - we can't expect other people to do it for us.

And so this was the path that we have chosen.

Perhaps there might be better paths out there but I am not familiar enough to explore those.

What is clear is that this upgrading journey is NOT suitable for everyone.

We all come from different financial backgrounds and experience level.

So consider this as merely a guide on the entire process.

If you are keen to learn more about what your own property options and what you can do, I invite you to contact me for a no-obligation consultation.

Drop me a WhatsApp message here: https://wa.me/6597733445/

Member discussion