HDB Upgrading Case Study: From a 3-room HDB to 4-room HDB In Buangkok

Some people may associate upgrading as changing your HDB to private property.

But for me, upgrading is essentially making a change to a better quality of life.

For a family of 4, upgrading from a 3-room HDB flat to a 4-room HDB flat is the best way to make a drastic improvement to a quality of life.

With the bigger space and extra bedroom, it is a chance for this family with young children to create a better environment for their kids to grow up in.

Was it possible to upgrade with a household income of $7K?

I met this local Chinese family while doing door-knocking.

They were open to the idea of exploring of the idea of upgrading due to the need for a bigger space.

With 2 young kids - 1 boy and 1 girl - they recognize the need that a bigger space is a good solution for the family.

It would be very inconvenient for this pair of siblings to continue sharing the same room.

However, the parents themselves were also very concerned about whether they could afford to make the move.

Both husband and wife were working but their combined income was only between $7k - $8k.

With their daughter attending Hougang Primary School, they also preferred to find a bigger 4-room flat in the same Buangkok area.

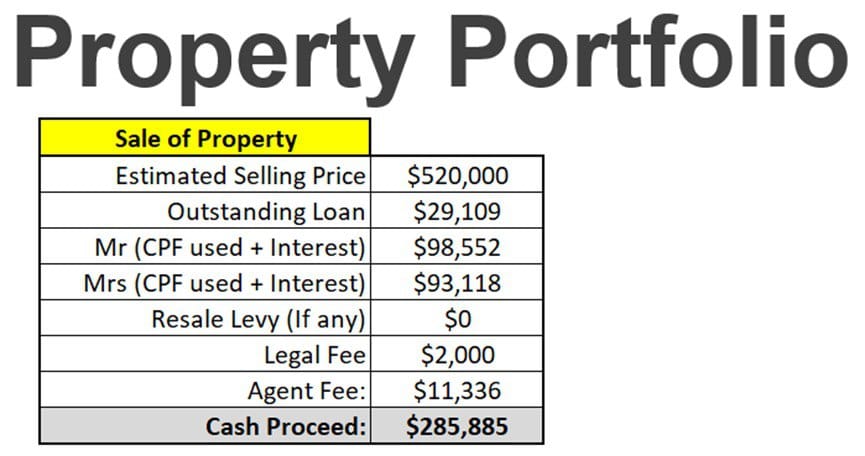

So we had a discussion where we discussed the financial numbers in detail.

Their 3-room HDB flat has just newly-MOP

They received the keys to the 3-room BTO flat back in 2018.

The price they bought it was about $2xxK back then.

Recent transactions of similar 3-room flats in the area was at $460K - $498K.

So I wanted to try to stretch it further and break a new transaction record within that area - so we aimed at $520K.

With such cash proceeds, I shared with them it is possible to upgrade to a 4-room HDB flat comfortably.

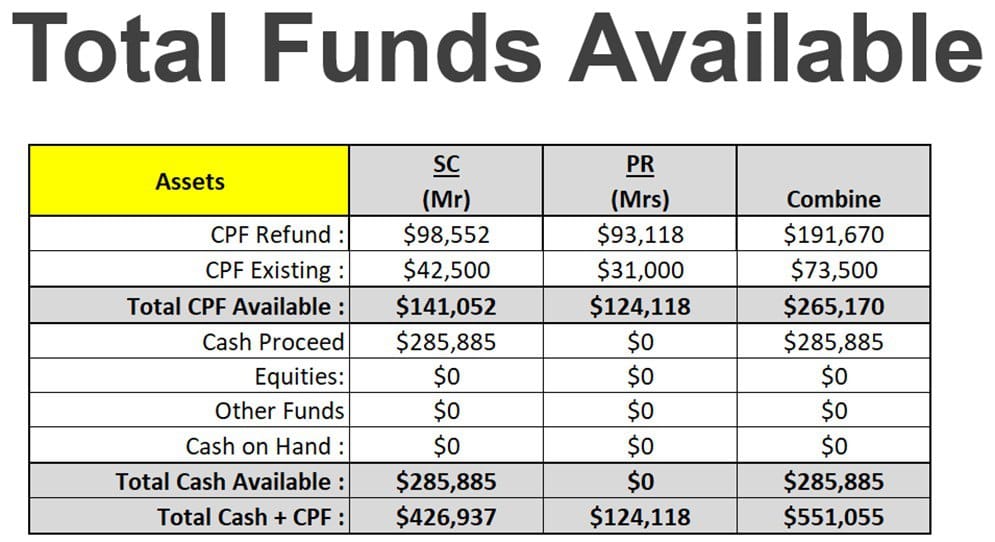

This is based on their total funds available from both husband and wife.

After combining their CPF monies and cash proceeds, they would have easily have $550,000 on-hand for the purchase of their next HDB flat.

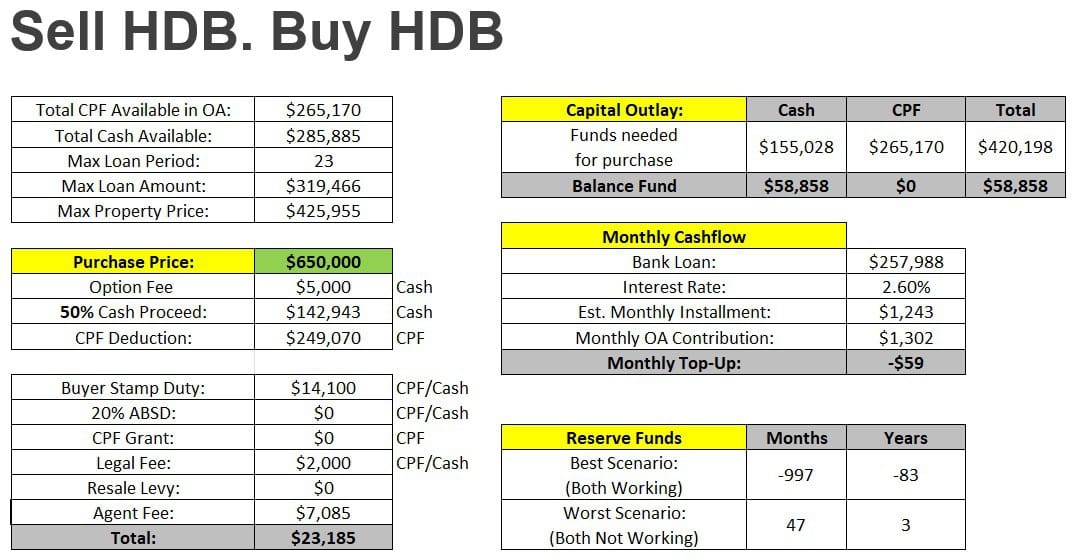

I showed them the calculations if they were to purchase a 4-room HDB at $650K.

If you were to study how I allocated the reserve funds, it showed that in the event that both were to stop working (means zero CPF contributions) - their funds could last them for 47 months or almost 4 years.

Based on a HDB loan of 2.6%, the monthly installment is $1243 - which means there is no need for cash top-ups as it can be fully financed by their CPF OA contributions.

This meant that the 4-room HDB that they are aiming for is easily within their reach with proper financial planning.

Did they proceed with the plan?

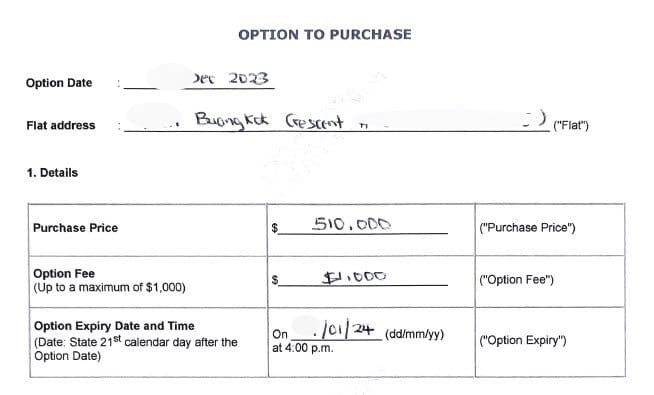

Yes, they did.

However they were some slight changes with the numbers.

I did not manage to sell their 3-room HDB at $520K.

But eventually it was sold at $510K - which was still a record price in that area.

It took us about 2 viewings to receive 2 offers.

We also did not secure a resale 4-room HDB flat at $650K...

But we managed to get it at $640K - within the same Buangkok area as well.

As we marketed the 3-room flat, we also searched for the next flat for them concurrently.

This allowed me to manage the timeline very smoothly and allowed this family to seamlessly move to their next home with no fuss.

Conclusion

For those homeowners who were lucky enough to secure a BTO, the bull run in the property prices is a chance for them to level up and secure a bigger home by pushing those gains to the next property.

For this family, their intentions was less on cashing out for investment purposes but more for securing a bigger flat that is more comfortable for their family of 4.

With this size of the loan, they should be able to pay off their flat in less than 15 years.

If you are considering the option of upgrading to a bigger flat as well, feel free to contact me for a no-obligation discussion.

We will sit down and do a detailed financial assessment on what is possible for you.

Member discussion