Buying From the HDB Resale Market? Here Are 6 Things You Must Take Note Of

For most homeowners out there, the HDB resale market is a natural place for them to explore their next home.

It's very common to see families upgrade from their 3-room or 4-room flat to a bigger flat for the space.

The HDB resale market is also the destination of quite a few private property downgraders when they enter their retirement stage.

HDB flats being public housing are subjected to strict rules and regulations.

Here I like to share 6 important factors that you should look out for when you are entering the HDB resale market as a buyer.

#1: Resale Levy

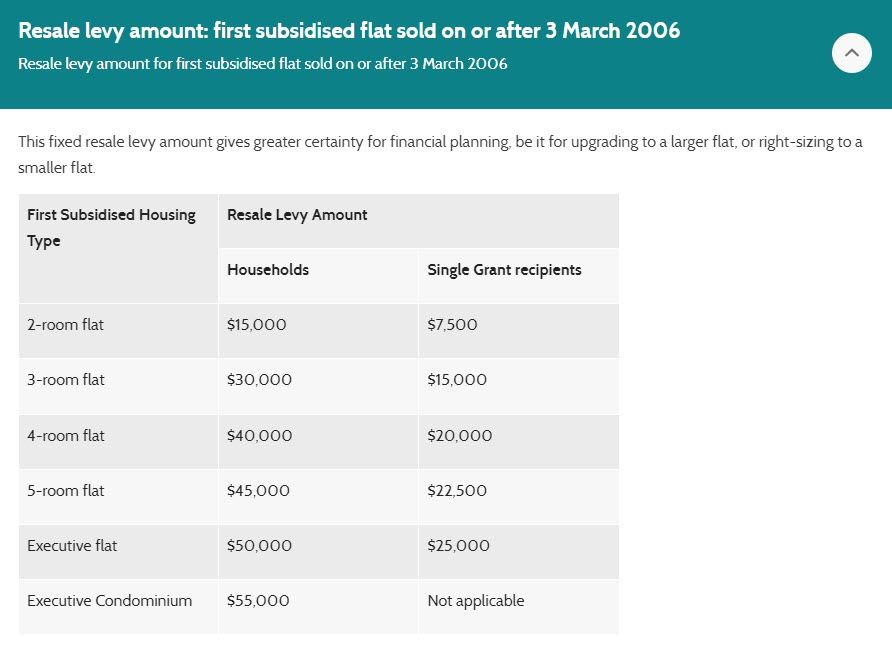

If you bought a subsidized flat directly from HDB (BTO or Sale of Balance flats) and you plan to buy another BTO next from HDB, you will be subjected to the resale levy.

The resale levy is a fixed amount of $40K for a 4-room HDB flat and $45K for a 5-room HDB flat.

Similarly, if you bought a BTO from HDB and bought an EC as your next property, you are also subjected up to a $50K levy.

Take note this levy has to be paid via cash and not CPF.

The resale levy can be quite a significant amount.

It can easily cover the renovation costs of your next home.

One of the ways to avoid paying the resale levy is buying your next HDB flat from the open market.

This means buying from other HDB owners who put up their property for sale.

When you buy from the open market, there is also the benefit of no income ceiling - so you can purchase whichever property you desire even if your household income exceeds $14k per month.

This is unlike buying directly from HDB where you will be subjected to a $14K income ceiling.

#2: Ethnic Quota

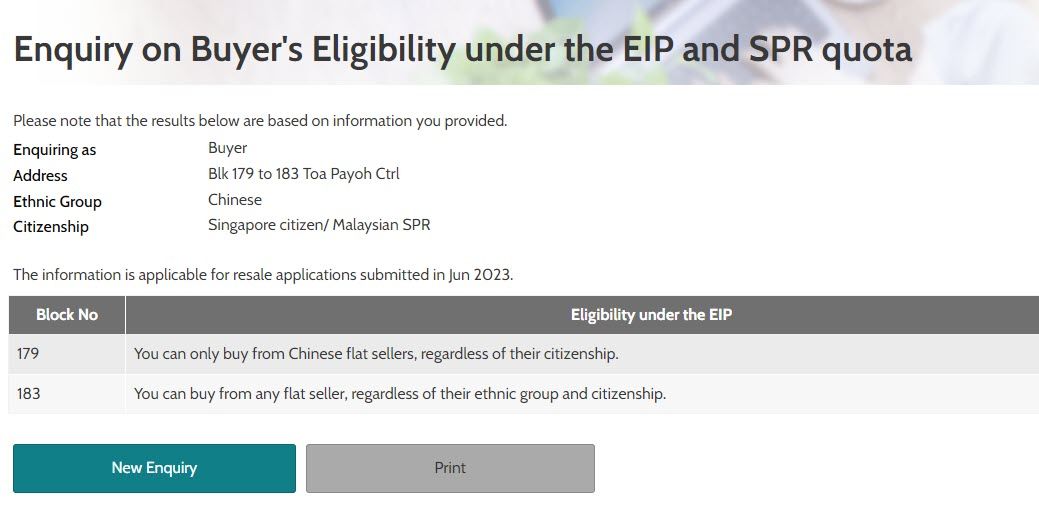

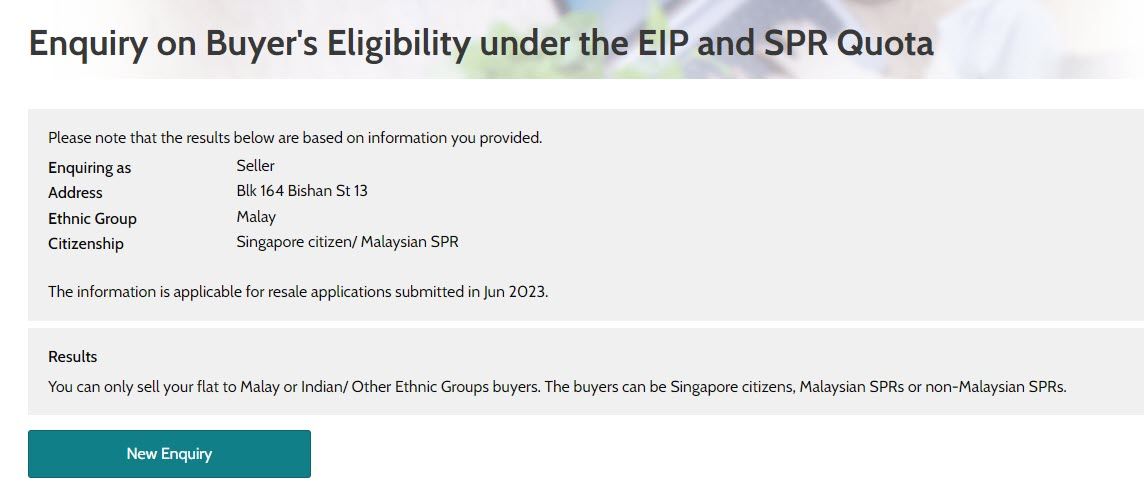

To promote racial integration and harmony in HDB estates, the Ethnic Integration Policy was introduced.

You can check on your eligibility to buy at certain locations by checking out this link below:

https://services2.hdb.gov.sg/webapp/BB29ETHN/BB29STREET

In some estates like Toa Payoh, this means you can buy only from Chinese owners if you are a Chinese.

Do take note of the impact of the EIP especially if you are buying into certain estates.

The quota is updated on the first of every month - so the results might vary from month to month.

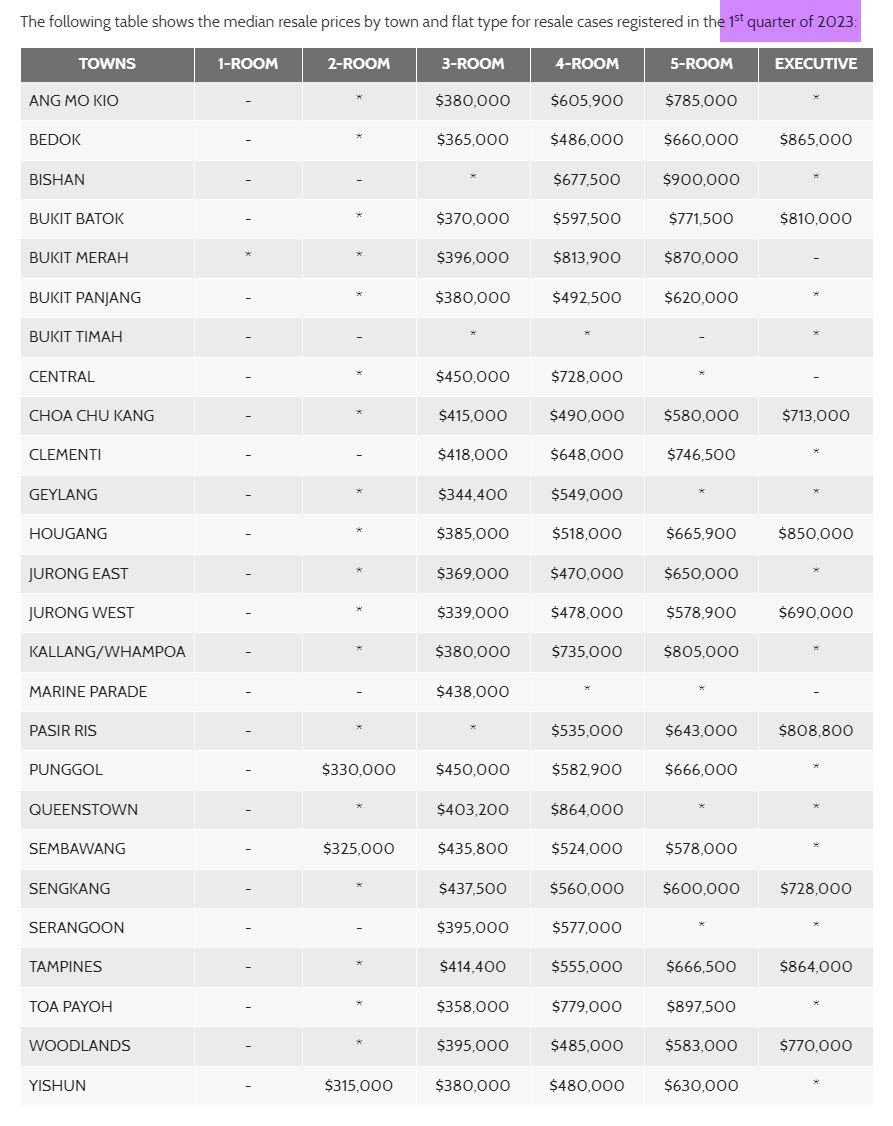

#3: Location vs Median Pricing

Below is the latest median pricing of HDB resale flats in the various estates.

For Punggol vs Sengkang, it seems that Punggol resale flats has greater demand than Sengkang.

I think it might be due to the fact that Punggol is the newer town with more sports amenities like Safra present.

It is also interesting to note that Woodlands flats have a higher median price than Yishun flats.

My observation is that it could be due Malaysian PRs preferring to buy Woodlands flats due to its close proximity to the Causeway and Johor Bahru.

Overall, these prices should be your guideline especially in prioritizing between your location needs vs budget.

#4: HDB Loan for 2nd timers

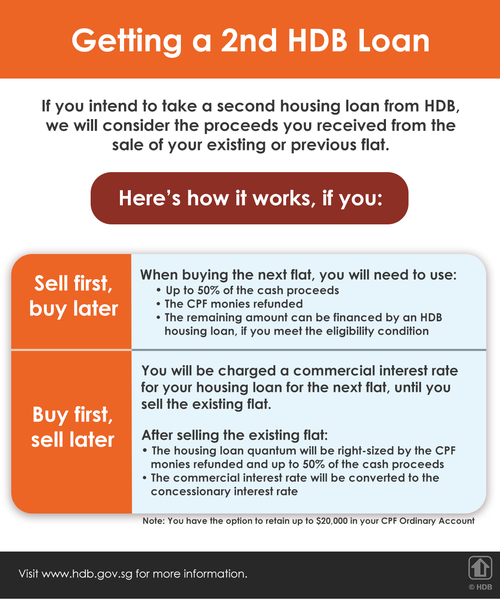

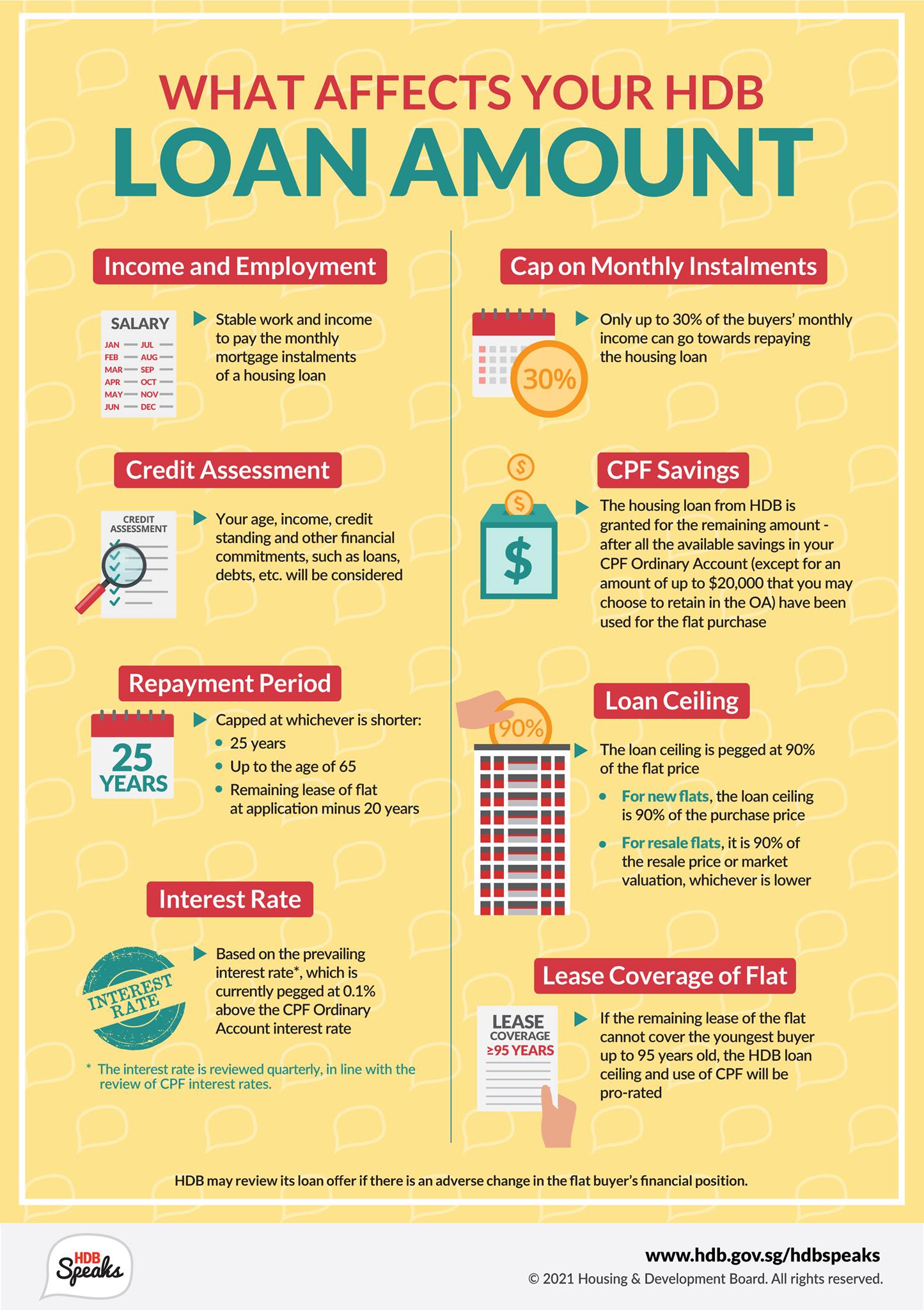

There are some restrictions you must be aware of if you are planning to take a HDB loan for the 2nd time.

Below is a useful infographic from HDB that you can refer to.

For most people - what will happen is that you will need to use up to 50% of the cash proceeds for the purchase of the next flat.

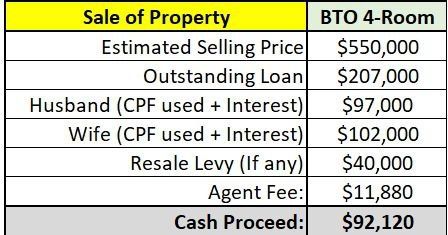

Here is an example calculation:

In this case, 50% of the cash proceeds will have to be used for the next flat purchase.

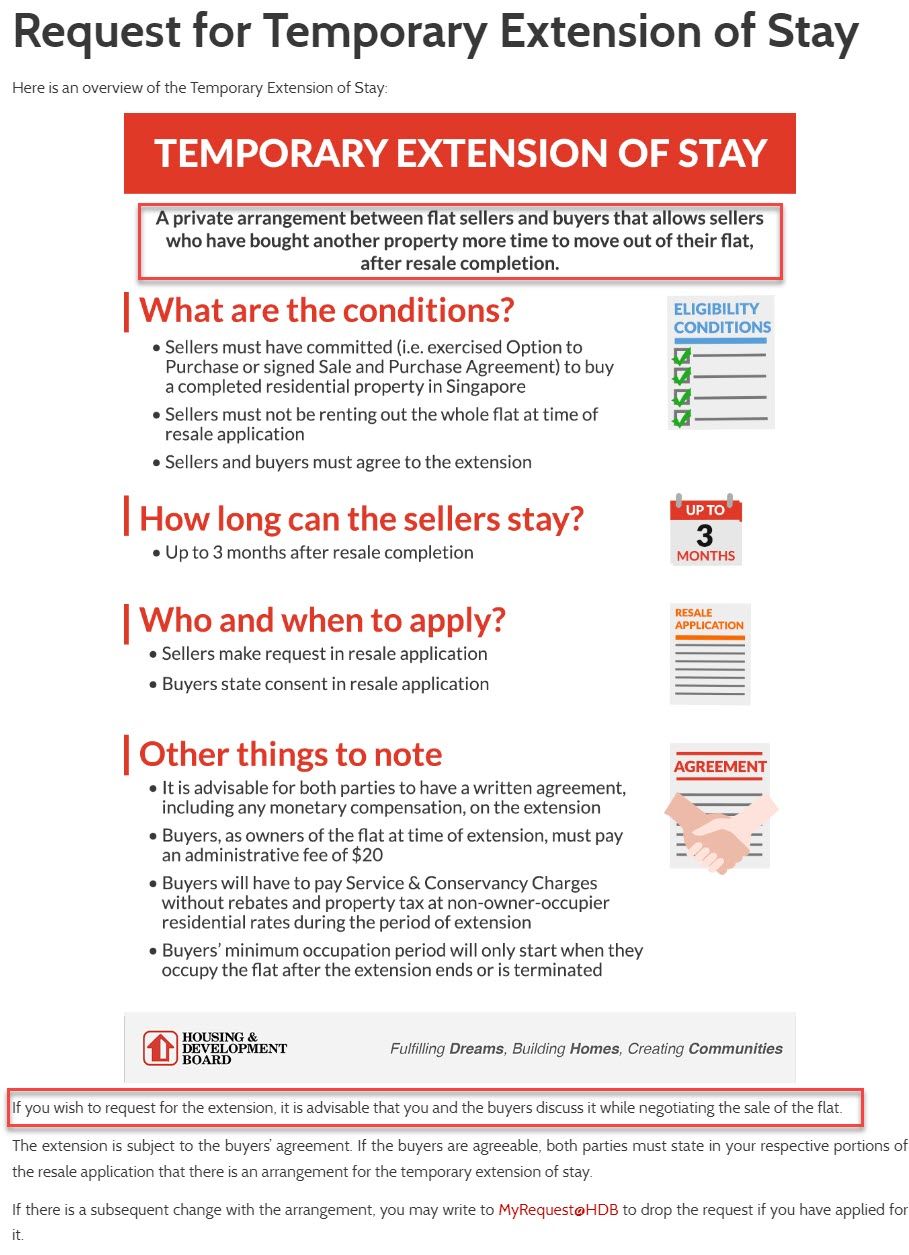

#5: 3-months' Seller Extension

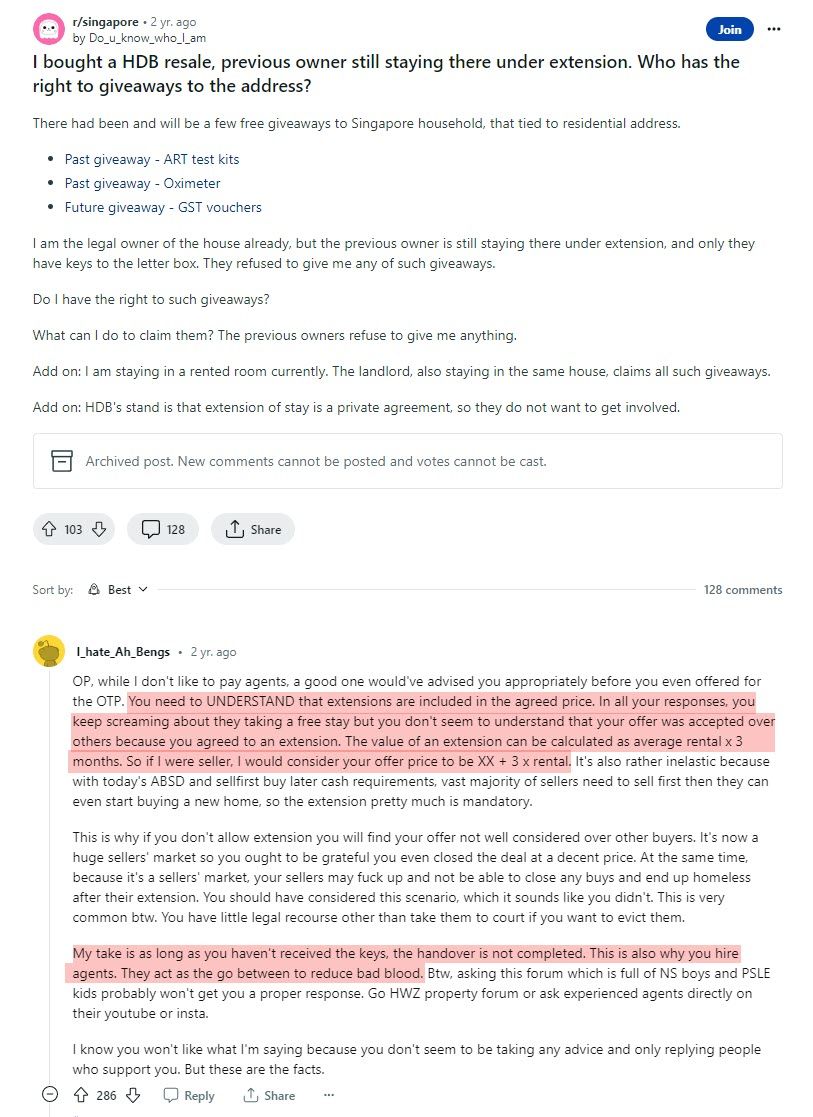

This is something all HDB resale buyers must understand before they provide an offer to the seller.

Usually, most sellers will require a 3-month extension after the completion of the HDB sale.

So technically, they will be staying in your HDB flat for an additional 3 months.

For example, the handover happens on the 1st of June.

With a 3-months seller extension, you as the buyer will only get the keys on 1st of September.

Should a buyer agree to provide a 3-month extension to the seller?

The 3-month extension is usually part of the negotiation process. A seller would take this into account when they are selecting a buyer.

If a buyer is unwilling to provide the 3-month extension, most sellers will reject such buyers.

And if a seller does not need the 3-month extension, such sellers will usually set a higher price.

So there is that balance that HDB resale buyers have to consider:

- to include the 3-month extension as part of their offer so it is much more attractive to the seller (without having to increase their offer price)

- to not offer the 3-month extension which means willing to offer a much higher price to the seller so it is more attractive than the other buyers' offer

In a resale HDB transaction, remember it is always about willing buyer, willing seller.

Essentially, this 3-month extension is part of the negotiation process. It is a private agreement between the buyer and seller.

You have to be aware of the impact and consequences of this 3-month extension.

For example:

- if there is a property tax that is due during that period - is it payable by seller or buyer?

- if there is an outstanding HIP payment due during that period - is it payable by seller or buyer?

- if there were items issued by the government during that period - will the seller get to keep it?

These are some of the things that have to be ironed out and discussed during the negotiation process.

Remember, you are the legal owner upon completion date - not upon end of the 3-month extension.

You can read this interesting post on Reddit on how this buyer seems to "misunderstand" the concept of the 3-month seller extension.

These are some of the nitty gritty details a HDB resale buyer have to take into consideration.

The reason why most buyers are not aware of this is because all these are usually taken care by the agent quietly and without much fuss.

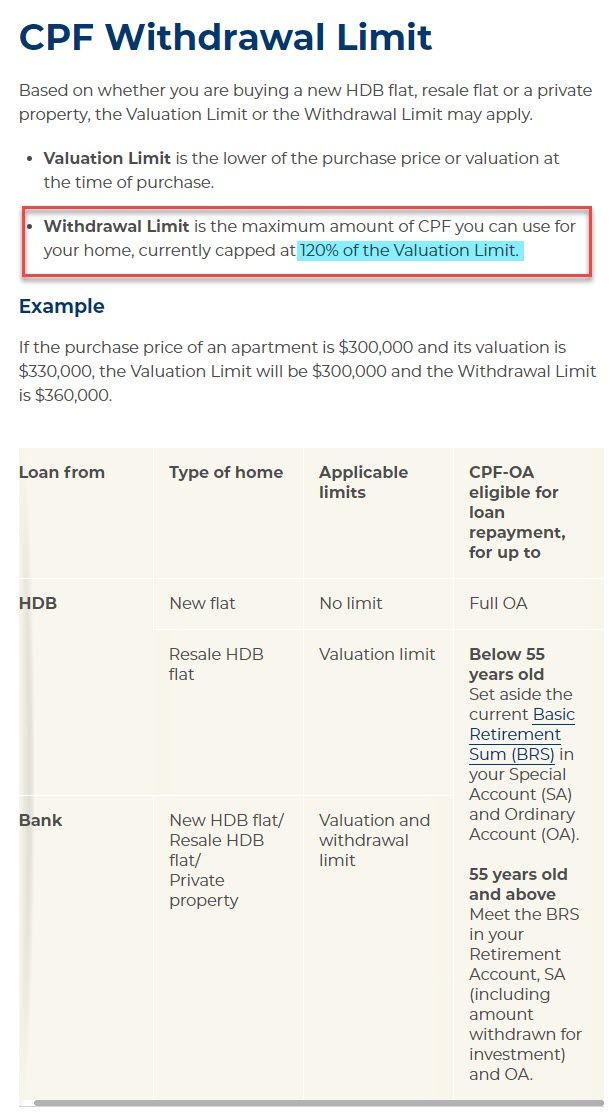

#6: CPF Withdrawal Limits

The final consideration you have to take into account is about the CPF Withdrawal Limits.

Most people assume they can use their fully use their OA to pay down their HDB loan.

However, as you approach the CPF Withdrawal Limit - which is 120% of the Valuation Limit - you will be restricted from using your OA.

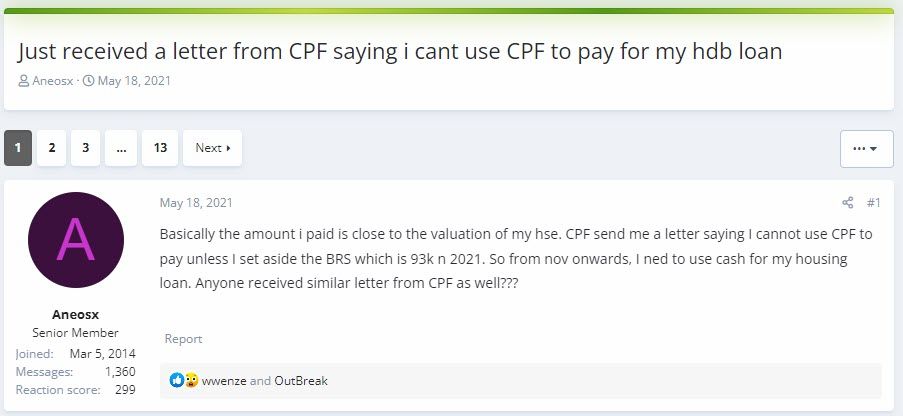

That's why for some homeowners who are at the tail end of paying off their HDB loan might receive a letter from the CPF Board that says they are not allowed to use their OA monies to pay down their loan.

This means they have to pay down the remaining loan using cash.

In this case below, the forum poster seems to need to set aside the Basic Retirement Sum first - before he can continue to use his CPF OA to pay down his loan.

This issue will only happen further in the future - it is usually when you used your CPF monies that is almost equivalent to the price of your resale flat.

Hence, that's why a lot of people are unaware of this issue until it happens to them.

Valuation Limit refers to the price of the property or its valuation (whichever is lower).

You can read more at this link:

https://www.99.co/singapore/insider/cpf-housing-withdrawal-limits/

Conclusion

As you can see, buying from the HDB resale market can be a very interesting process and not so straightforward.

There are a various pitfalls or obstacles that you can encounter if you did not do your due dilligence properly.

You can check the entire overview here: https://www.hdb.gov.sg/residential/buying-a-flat/buying-procedure-for-resale-flats/overview

My goal here is to equip you with the right knowledge so that you will not be too clueless on the various rules and regulations.

If you are a buyer who wish to be provided clear guidance and be supported in the search of your dream home in the HDB resale market - take note that most agents will charge a standard rate of 1% as commission.

This is quite different from the private property market where buyer agents share commission with the seller agent.

Why the difference?

This is due to much more significant paperwork required for a HDB transaction to happen. For me, I also charge the same 1% rate to HDB resale buyers who engage my service.

Have questions?

Drop me a WhatsApp message using this link below:

https://wa.me/6597733445/

All our discussions are no-obligation.

Some FAQs:

1. The agent representing the HDB seller seems to ignore me when I tell him I have no agent. Why?

Yes, this happens sometimes.

Most seller agents hate the complex paperwork required for HDB transactions - so they prefer to work with another buyer agent. This is because the buyer-agent would have educated and qualified their buyer-clients.

The presence of a buyer-agent means everything has been vetted properly. This provides greater assurance to the seller side.

On the other hand, the absence of a buyer agent will usually indicate to the seller agent that you might NOT be a serious buyer and thus giving them a reason to ignore you.

2. What happens after I sign the OTP?

After signing the OTP, the buyer will need to submit the OTP to HDB to obtain the valuation.

This valuation report costs $120 which is payable by the buyer. This is where the buyer will see whether the agreed selling price matches the valuation.

If it matches, then all is good and no COV is payable.

But if the valuation is lower than the agreed selling price - then there will be COV payable.

For some buyers, this is the worrying part because the COV can be beyond their budget.

3. What is the legal implications of the buyer backing out after exercising the OTP?

There is a difference between signing an OTP vs exercising an OTP.

Signing an OTP without exercising means as buyer you forfeit the deposit you gave to the seller.

Just a small financial loss.

But if the buyer were to back out after the OTP is exercised, then this can invite legal action from the sellers.

This is because you have disrupted their timeline planning for their next property.

This is a very serious situation which I recommend you do your best to avoid.

4. I want to save on that 1% buyer agent commission. Is this advisable?

If you are confident that you did not miss out on any pertinent issues like your loan quantum or the 3-month extension - then you can proceed with the purchase.

However, I have seen some issues where buyers who did not engage agent make a mistake when making their offer.

The buyers never considered the possibility that the Cash-Over-Valuation was beyond their budget. This is when the valuation report turns out to be lower than expected.

That's why you need an agent who can guide you on what is the best price to offer based on your financial capabilities and the market value of the HDB resale flat.

In a HDB resale transaction, the seller wants the highest price possible while the buyer wants the lowest price possible.

The purpose of an agent is to keep you from becoming too emotionally involved and keep you at arms' length so you can make a decision in a clear-headed manner.

Buying a home is actually quite an emotional process:

You will feel excited at first, then slowly you feel worn out and finally you might feel "aiyah just pay lah".

And that's when the agent on the opposing side can take advantage of you.

It is important that you have someone on your side to protect your interests.

5. Should I apply for the HDB Flat Eligibility Letter (HFE) before I start my search?

Yes.

You should apply for the HFE before you even start your HDB resale search.

I helped a client to apply for the HFE before and I noticed it is a long questionnaire that takes some time to complete.

Take note the processing time also takes 21 working days before you get the results.

Member discussion