Are You Feeling Priced Out of New Launches?

Singapore's real estate market has been experiencing a boom in the past few pandemic years, with new property launches springing up across the island.

In 2022, we were greeted with headlines where launch after launch of suburban condos becoming almost sold out.

The first major launch of a suburban project is almost fully sold on first day of sales, with just seven units out of...

Posted by EdgeProp Singapore on Saturday, July 23, 2022

With 508 units sold on the first day of launch, the 605-unit Lentor Modern is the best-selling project of 2022 to date 📨 Follow us on Telegram: edgepr.link/EPTelegram

Posted by EdgeProp Singapore on Sunday, September 18, 2022

First-day sales of 465 units at Copen Grand translates to a conversion rate of 20.3% based on the 2,300 e-applications received 📨 Follow us on Telegram for the latest updates: edgepr.link/EPTelegram

Posted by EdgeProp Singapore on Saturday, October 22, 2022

I've met some people who asked me this question:

Why are so many people snapping up these condos at high record psf prices?

Who are these people buying?

I also recognize the hidden question being asked:

How are these people able to afford this high-priced new launch condos?

Let's explore what is going on behind these headlines and what insights we can learn from them.

Insight #1: Sold-out new launches are an indicator of demand

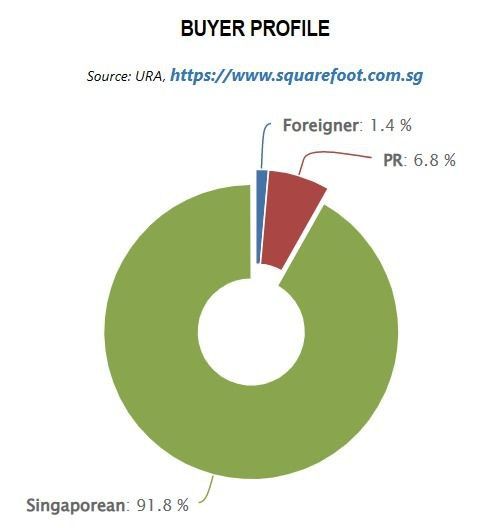

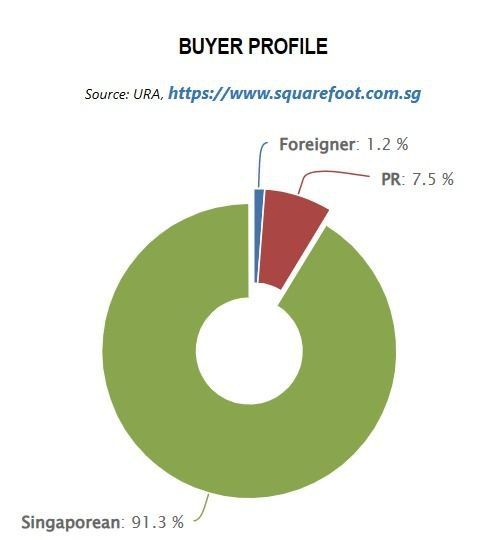

There was speculation that most of the demand for these new launches were fueled by foreigners who were looking to park their assets in Singapore.

However, if you look at the profile of the buyers, you can see that majority of them are Singapore citizens.

The locations of AMO Residences, Lentor Modern and Copen Grand EC are not exactly in a central part of Singapore.

In fact, all of them are considered as OCR - Outside of Central Region.

This brings me to the next insight.

Insight #2: There will always be fans of each location

If we spent a majority of our childhood in Ang Mo Kio, we tend to be biased and prefer that location when we become older.

I call it the nostalgic factor.

That's why there is strong demand for AMO Residences - there hasn't been a new condo launch in Ang Mo Kio for more than 8 years.

Buyers were primarily local home buyers with several families buying multiple units so that they can reside in the same vicinity.

"They are mostly owner-occupiers, and based on what we observed, they are particularly attracted to the project's proximity to Mayflower MRT station, popular schools, lush parks and shopping malls." - ST article, 24 July 2022

Just 7 units were left unsold on the first day.

Posted by The Straits Times on Sunday, July 24, 2022

We are fans of what we are familiar with and will naturally be attracted to.

This is something I can personally attest to when my wife and I were visiting various property launches and showflats back in 2018.

Despite the wide variety of choices available back then, we realized we kept going back to this particular showflat.

The main reason we picked Park Colonial?

We were very familiar with the location as my parents stayed nearby.

Insight #3: Some buyers are being assisted financially by family

To be fair, I have no clear data on this. But this is something we can infer based on the sales response of Copen Grand EC.

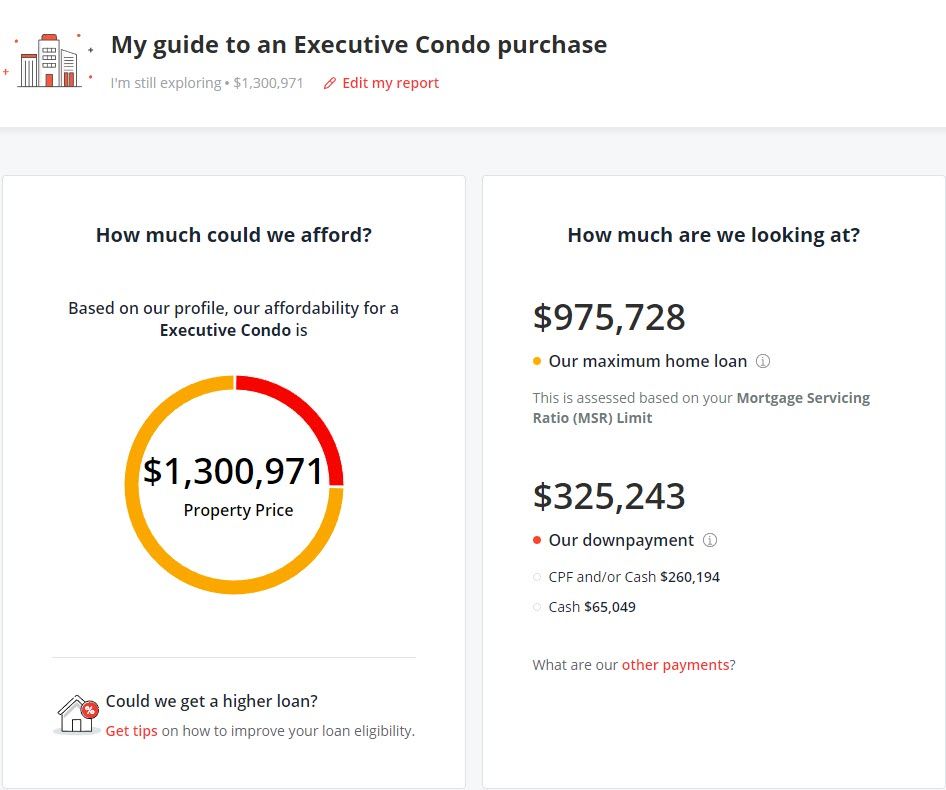

To purchase an EC in Singapore, you are subjected to the Mortgage Servicing Ratio (MSR) which is far more stricter than TDSR.

If the combined household income is $16K per month which the income ceiling for buying an EC, then the maximum loan you are eligible to get is about $975K. (based on DBS calculator)

In this best case scenario, the price of the EC that you can afford is $1.3M.

However for Copen Grand EC, the 4-bedder units starts from at least $1.48M and 5-bedder units starts from $1.88M.

Since all buyers of ECs are subjected under the MSR that is coupled with an income ceiling of $16K, it means the buyers of these larger units have:

- accumulated a significant amount of cash savings or CPF monies

- access to significant amount of cash

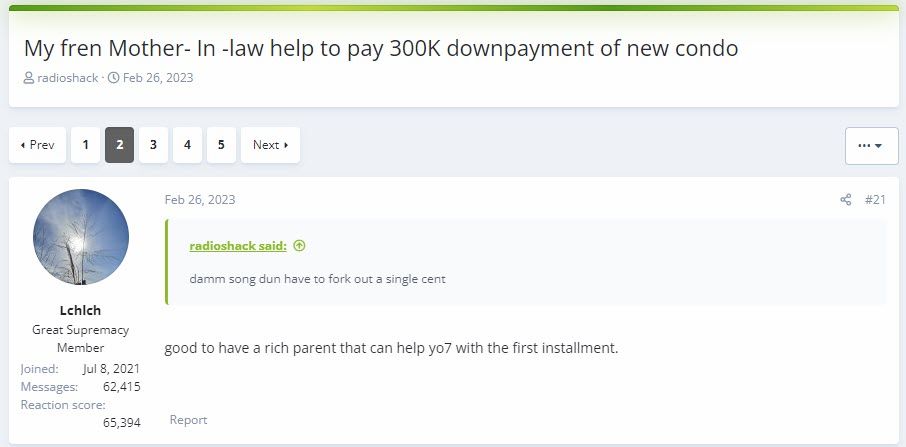

The most likely scenario are that these buyers have likely received financial support in the purchase of their unit at Copen Grand EC - in the form of a cash gift or a goodwill loan from parents.

(Take note that Copen Grand EC is 100% sold out.)

Insight #4: Singapore's household income is rising

Instead of referring to the news, I decided to go directly to the source at https://www.singstat.gov.sg.

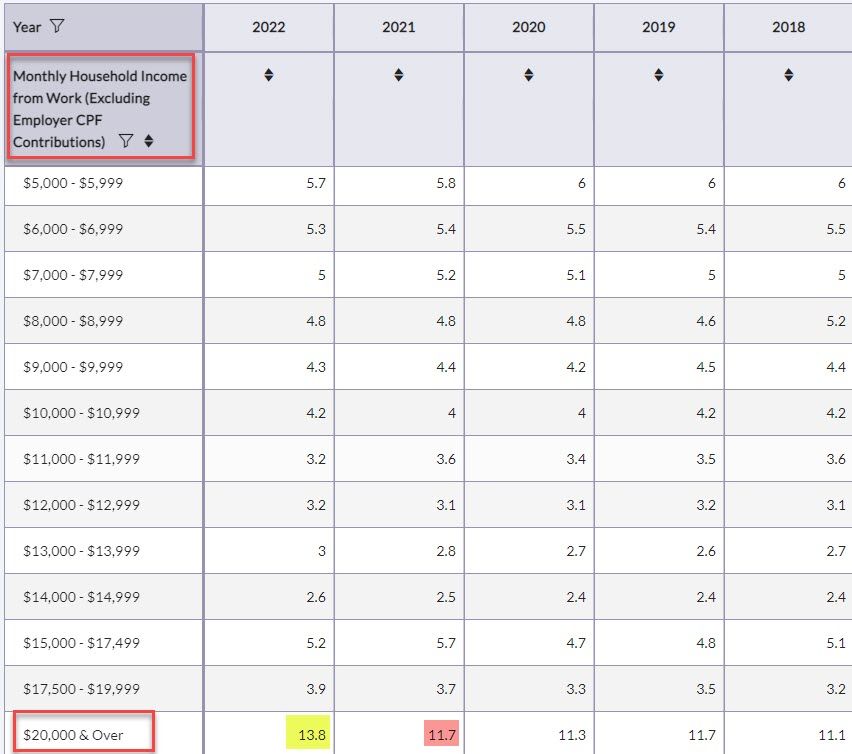

Here I went to check out the data on the household income that excludes CPF.

If you check out the link, there was an increase in the number of households with a monthly household income of $20,000 and over.

In 2021, only 11.7% of households has a monthly household income of $20K and above.

In 2022, this number rose to 13.8%.

What this tells me is that we have more and more households whose income are exceeding $20K and there was significant increase in 2022 compared to previous years.

Singapore is indeed becoming wealthier and wealthier with rising income levels.

Conclusion

I understand the feeling that owning a new private property seems to be slipping further and further out of reach due to skyrocketing prices.

The easing of COVID-19 measures in April saw a rise in the number of show flat and private home viewings, says an analyst.

Posted by CNA on Thursday, July 21, 2022

But in January 2023, there seems to be a slight fall - the first time in 2 years.

Whether this trend will hold up - we are still unsure.

From talking to sellers, buyers and fellow agents - there seems to be a slight cooling in prices - from hot to warm.

However, do take note I am referring to the resale market.

The last time prices registered a decline was September 2020, when resale prices slipped by 1% after the pandemic’s onset and implementation of safe-distancing measures, says an observer.

Posted by The Business Times on Sunday, February 26, 2023

For new launches, the biggest factor that will guide the behavior of property developers will be the land prices.

Developers want to turn a profit and with increasing prices of raw material and labor, it is highly unlikely for the prices of new launches to go down.

They too are thinking about how to attract buyers to their showflats and yet be able to cover their own rising costs.

If you have plans to enter the property market this year, feel free to contact me for a no-obligation discussion.

We can sit down and explore your options.

P.S. The Business Times published this on 23 April 2023.

“We think that typically, where budget permits, a four-room flat tends to be a good size for a first home for young...

Posted by The Business Times on Saturday, April 22, 2023

Member discussion