5 Financial Exit Strategies For Elderly Homeowners In Singapore

Recently, I met up with an elderly homeowner who was in his 60s.

He has been staying in a 4-room HDB flat and was looking to downgrade to a smaller 3-room flat and use the cash proceeds as part of his retirement nest-egg.

Looking at the age of his flat and current valuation - he could cash out perhaps $150K and purchase a 3-room flat at a non-mature location.

The amount of cash proceeds really will have to depend on the location and size of the next flat.

I realized that this is a very common issue that a lot of Singaporeans will face in the future as we grow older and the lease of our property start to decay.

At the same time, the rising costs of living means the sandwich generation will be stuck between trying to support both our elderly parents and our young children.

As we park a significant portion of our CPF monies into our home, the property choices we make can really make an impact on our future retirement plans.

Here I explore 5 financial exit strategies for elderly homeowners in Singapore.

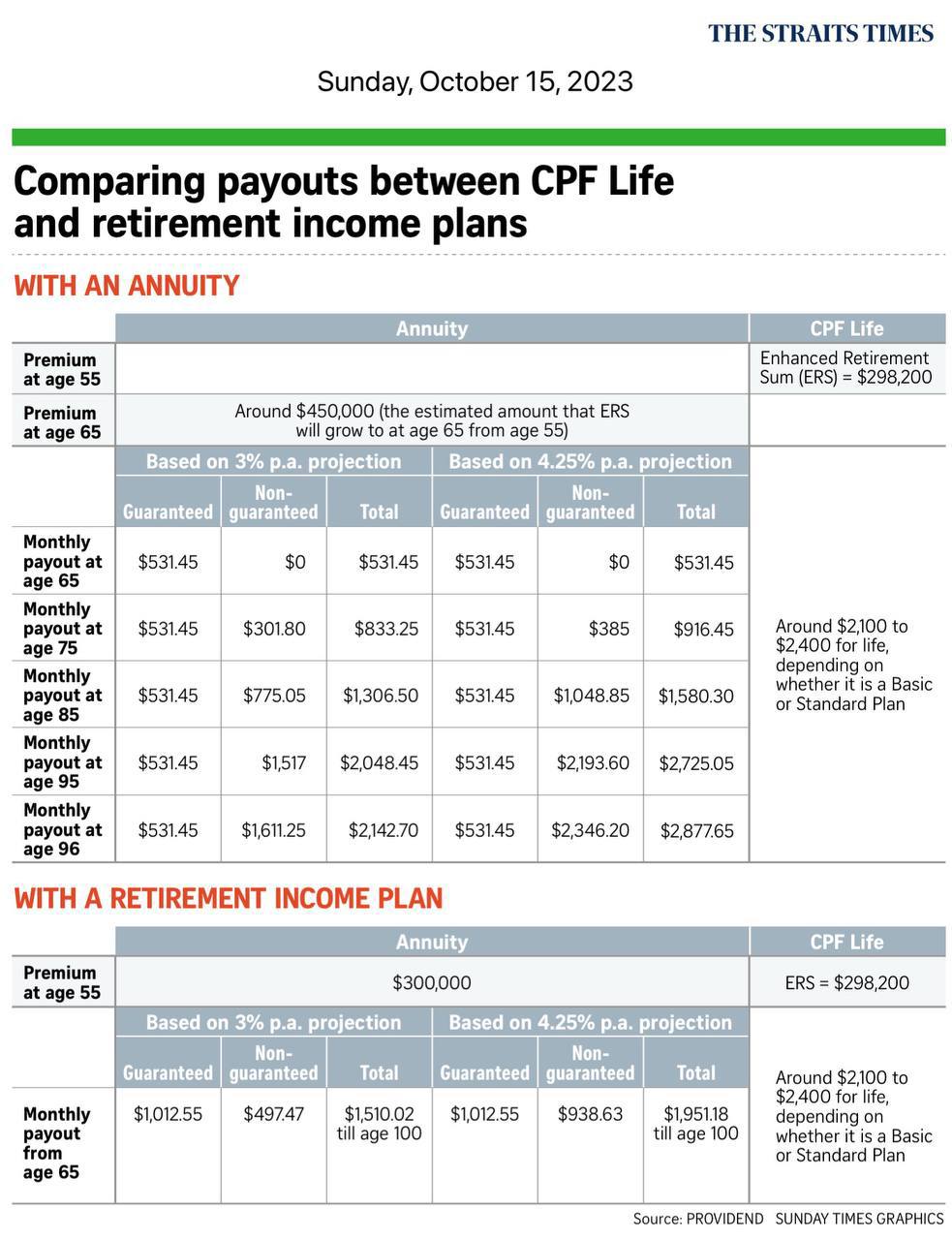

#1: Rely on own investments like CPF Life and/or private annuity plans. Housing is purely treated as an expense.

For this group of homeowners, they have adopted the mindset that the residence that they stay in is really a home that is considered as an expense.

They have already set aside other forms of investments where they are already receiving passive income from which could cover their living expenses.

They are likely to be a group who planned their retirement income decades ago and are now comfortable to remain in their current home.

They might have fully paid off the property and are comfortable to let those monies remain inside their home.

#2: Rent out your home or individual rooms and retire in another country.

I have heard of this plan regularly from those who are relatively younger, healthy and mobile.

They tend to be more optimistic of uprooting their lives to setup another new life overseas.

With lower costs of living in neighboring countries, this is a version of geo-arbitrage we Singaporeans can leverage on - thanks to our strong SGD.

However, there are also cases of where tenants take advantage of the fact that the landlords are overseas.

And do their own version of rental arbitrage.

There is also the option of renting out spare rooms while still remaining to stay within the unit.

However, this is not a popular choice due to the loss of privacy.

Sometimes we are so used to staying in our home that the idea of sharing our private spaces with strangers will be difficult to accept.

But rental income is a viable option to for the elderly to monetize their current property without selling it off.

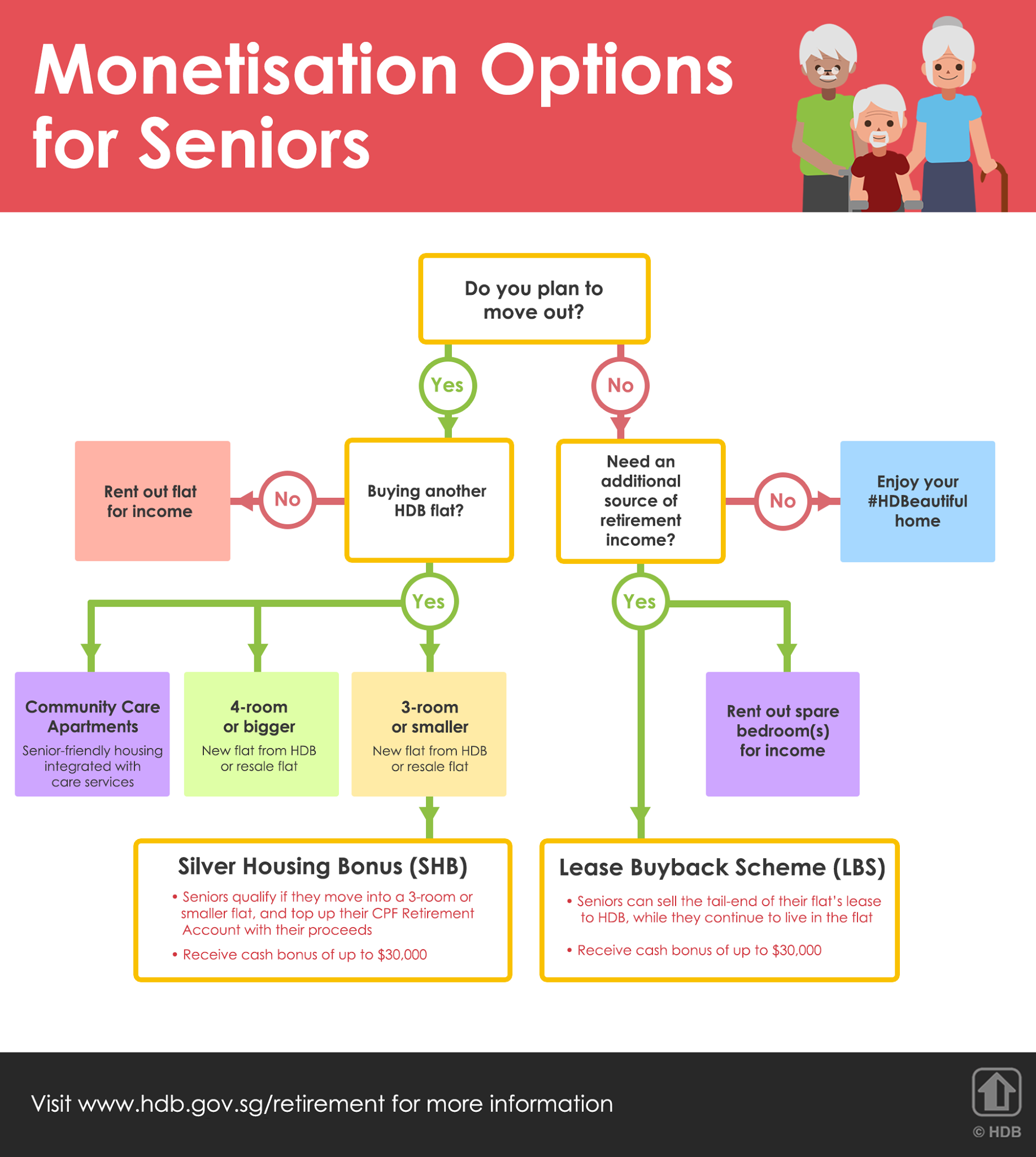

#3: Lease Buyback Scheme (LBS) - Sell off a portion of the remaining lease

The Lease Buyback Scheme was introduced to improve the retirement adequacy of elderly flat owners by enabling them to sell a portion of the lease of their HDB flat to the Government.

The proceeds can be used to top up one’s Central Provident Fund (CPF) Retirement Account savings and join CPF Life.

In return, they receive a stream of income in their retirement years, while continuing to live in their flat.

This scheme was initially unpopular at first but it is slowly gaining traction.

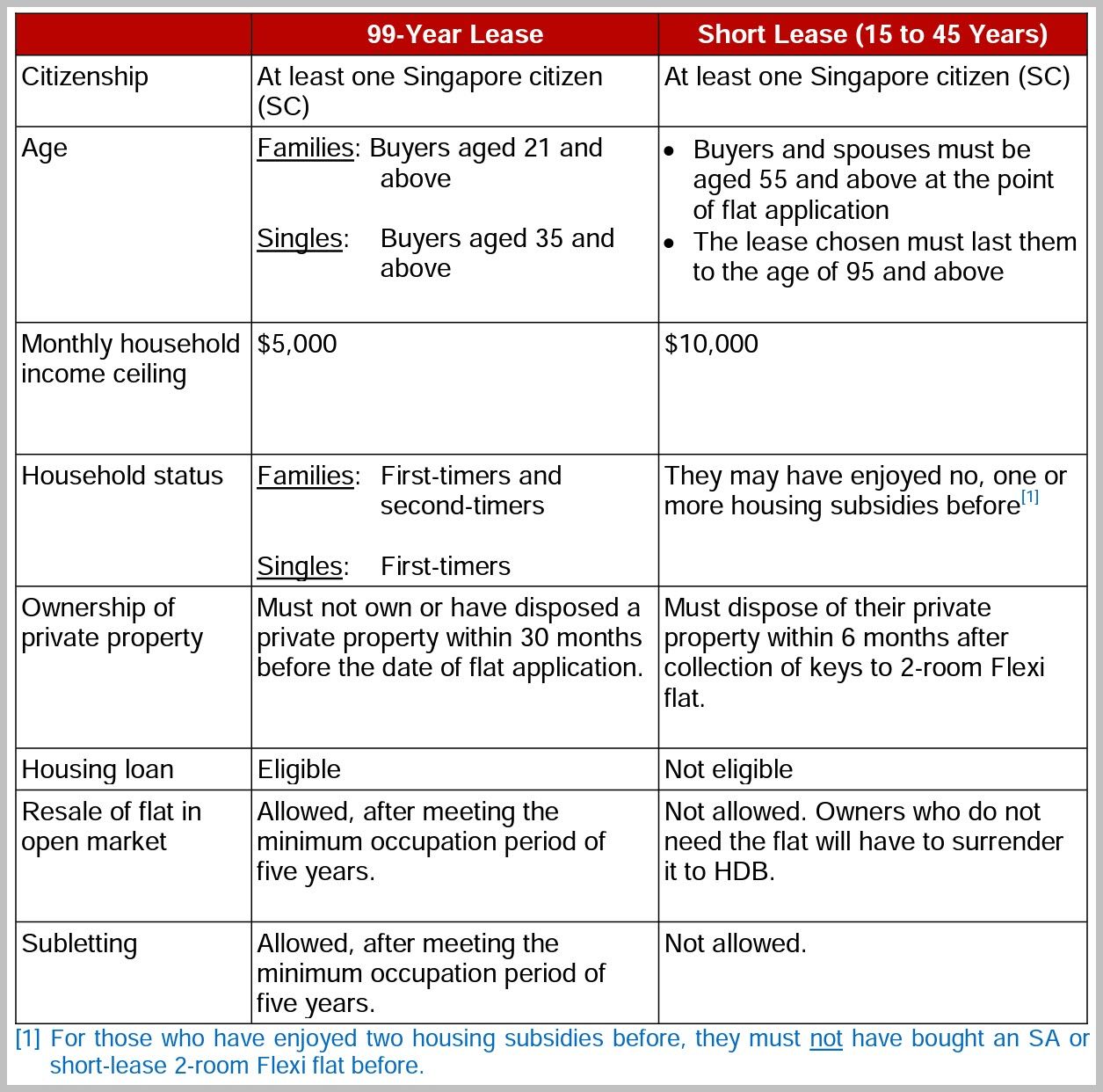

The LBS has been enhanced to allow households the flexibility to choose the length of lease to be retained, based on the age of the youngest owner, that is, retained lease to last the youngest owner till at least 95 years old.

The flat is then returned back to HDB upon death of the owner or end of the remaining lease.

This is another form of "self-funding" for retirement where the remaining years of the lease is monetized to flow back as additional income using CPF Life as the retirement vehicle.

The advantage of the LBS?

It allows for comfortable aging in place.

The elderly homeowners no longer needs to move out and can stay in their homes for the rest of their lives.

For HDB owners aged 65 and above and with their children already owning their own flat or property - this is a good option to consider if you wish to supplement your retirement nest egg.

#4: Silver Housing Bonus - a form of downgrading to a smaller HDB flat

The Silver Housing Bonus (SHB) uses a cash bonus incentive to encourage senior households to downsize their existing property to a lower value 3-room or smaller HDB flat while putting a specified sum of their cash proceeds from the sale of their existing flat into their CPF Retirement Account.

Similar to the LBS, the elderly homeowners must also participate in CPF Life - where they purchase a life annuity using the proceeds from the sale of their existing flat.

All monies in the CPF Retirement Account will be used for CPF Life, which will give seniors a monthly retirement income for life.

The incentive for participating in the SHB is a cash bonus up to S$30,000 which adds on to their retirement nest egg.

So the typical pathways are usually from a bigger HDB flat to a smaller 3-room or 2-room HDB flexi-lease flat.

With the prices of 2-room flexi-lease HDB flats being as low as $200K, it means more is available for the retirement nest egg.

#5: Sell off existing flat and downgrade to a smaller flat

As an agent, this is what I commonly encounter from homeowners who wish to cash out from their existing flat especially in today's current peak property market.

There is demand from the younger families who wish to upgrade to a bigger flat for the space and amenities.

And they can be quite willing to pay for it.

For this group of people who value space, location and amenities - they understand it is not about making returns on their property. But a place where they can fulfill their lifestyle dreams.

So the HDB resale market can be your form of exit strategy to boost up your retirement nest egg.

For those homeowners who wish to downsize to a smaller flat as you enter the retirement stage, you should consider doing a financial assessment to check what property options are open to you.

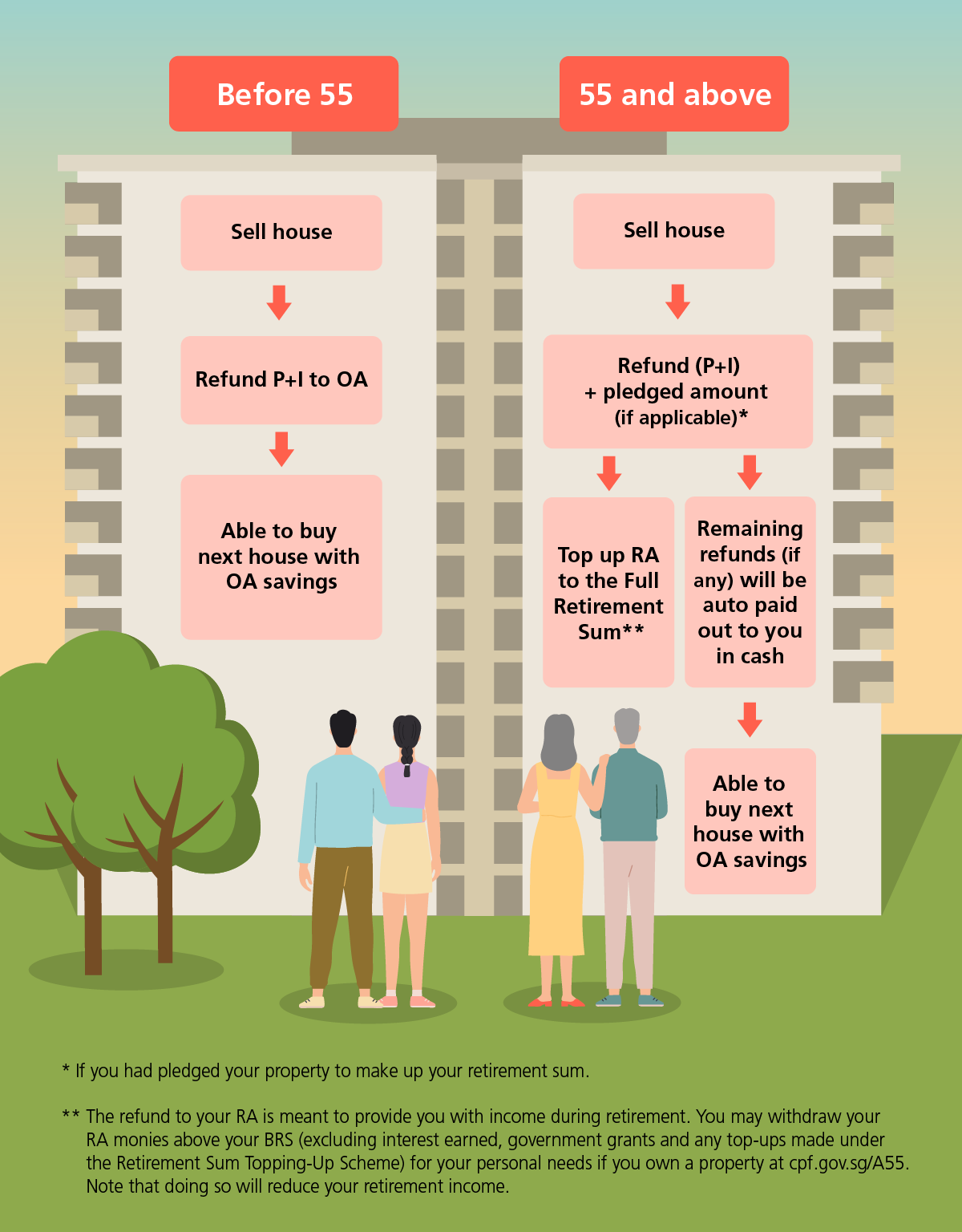

Downgrading is not always so straightforward - you have to remember that if you are above 55 years old - you have to top up your CPF Retirement Account to the Full Retirement Sum first.

The Emotional Aspects of Aging vs the Financial Facts of Reality

HDB has actually rolled out various monetization plans for aging HDB owners.

The LBS is unique in a sense that a similar plan is not available for private property owners - it is only open to HDB owners aged 65 and above.

If you have dealt with elderly family members, you will understand that for most of them it is not so much about the money.

But about being in a place that they are familiar and comfortable with.

Staying in the same place provides a feeling of security and safety.

Many are also emotionally attached to the house especially with all the fond memories and neighborhood - and have no desire to move elsewhere.

But it is also true that with we grow older, it comes with a package of deteriorating health and increasing medical expenses.

That's why boosting our retirement nest egg is so important.

I believe many of the elderlies want to be independent and not be overly dependent on their children for financial support.

What can we do?

Explore all these options early. Lay out your plans early and do a financial health check with regards to your property and retirement plans.

As you can see, 55 years old is a critical age that has been set by the CPF Board where it is a requirement to top up the Retirement Account to the Full Retirement Sum (FRS) if we were to sell off the HDB flat.

Conclusion

What all these monetization options have in common is this:

As Singapore citizens, we are expected to use CPF Life as one of our retirement vehicles.

Topping up our CPF RA with proceeds from the sale of our property seems to be the standard requirement.

I guess since we withdrew monies from our CPF OA for housing, it is only right the monies should be returned back to CPF for our retirement.

The topic of retirement and our housing choices is always intertwined in the context of Singapore.

Stephen Covey stated that one of the 7 Habits of Highly Effective People is to - "Begin With the End in Mind."

Start preparing now so we don't have to suffer through big shocks that might happen.

If you have aging family members or even looking to start planning for your own retirement future, do start exploring all your possible options through a detailed financial health check.

I invite you to contact me for a no-obligation discussion to find out the financial feasibility of these options.

Resources:

https://www.cpf.gov.sg/member/infohub/educational-resources/selling-your-flat-age-55-cpf-refund

Member discussion